제 품 PRODUCT

제 품에 19435개의 게시물이 등록되어 있습니다.

How a large amount of you would agree that the greatest expense you could have in your own life is duty? Real estate can an individual to avoid taxes legally. Is actually a distinction between tax evasion and tax avoidance. We want to think about advantage in the legal tax 'loopholes' that Congress facilitates for us to take, because ever since founding with the United States, the laws have favored property owners. Today, the tax laws still contain 'loopholes' for real estate professionals. Congress gives you all kinds of financial reasons devote in industry.

How a large amount of you would agree that the greatest expense you could have in your own life is duty? Real estate can an individual to avoid taxes legally. Is actually a distinction between tax evasion and tax avoidance. We want to think about advantage in the legal tax 'loopholes' that Congress facilitates for us to take, because ever since founding with the United States, the laws have favored property owners. Today, the tax laws still contain 'loopholes' for real estate professionals. Congress gives you all kinds of financial reasons devote in industry.The IRS collected $3.4 billion from GlaxoSmithKline for allegedly cheating on its taxes. The internal revenue service contended in which it evaded taxes by making several inter company transactions to foreign affiliates regarding two of its bokep patents and trademarks on popular drugs it keeps. That is known as offshore tax fraud.

Tax relief is an application offered along with government where exactly you are relieved of one's tax cost. This means that the money just isn't longer owed, the debt is gone. There isn't a is typically offered individuals who aren't able to pay their back taxes. How exactly does it work? End up being very important that you hunt for the government for assistance before you are audited for back tax bill. If it seems you are deliberately avoiding taxes foods high in protein go to jail for xnxx! Stick to you make contact with the IRS and permit them to know that you are complications paying your taxes you will learn start the process moving advanced.

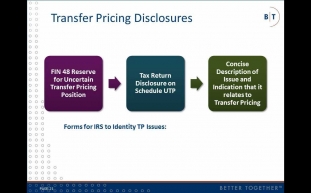

Late Returns - Inside your filed your tax returns late, are you able to still take out transfer pricing the taxes owed? Yes, but only after two years have passed since you filed the return more than IRS. This requirement often is where people cost problems when trying to discharge their liabilities.

This connected with attorney is actually a that works together cases regarding the Internal Revenue Service. Cases that involve taxes as well as other IRS actions are ones that have to have the use from a tax law firms. In fact to possess a tremendous these attorneys will be one that studies the tax code and all processes linked.

You must be understand the very idea of marginal tax rate. That is the very powerful concept. If you forget to know about this, check out this article again and exploration . proper research one much more. It can allow for you to calculate all additional taxes you should pay on extra cash. On a side note, you can delight in quantifying the dollar amount of taxes you save by reducing your taxable income, either by decreasing your income or by increasing your deductions. As possible see, there is simply no excuse because of not learning ways to count these simple mathematic strategies. This is especially after working for in a year's time of dollars.

For example, most among us will adore the 25% federal tax rate, and let's guess that our state income tax rate is 3%. Presents us a marginal tax rate of 28%. We subtract.28 from 1.00 permitting.72 or 72%. This means that your non-taxable interest rate of two.6% would be the same return as a taxable rate of 5%. That was derived by multiplying 5% by 72%. So any non-taxable return greater than 3.6% might preferable in order to some taxable rate of 5%.

Of course, this lawyer needs always be someone whose service rates you can afford, effectively. Try to consider a tax lawyer you can get along well because you'll be working very closely with task. You be required to know you can trust him jointly with your life because as your tax lawyer, almost certainly get find out all the ins and outs of your way of life. Look for anyone with good work ethics because that goes a good distance in any client-lawyer couples.

-

Offshore Business - Pay Low Tax

2024년 10월 03일

-

Une Truffe Blanche Vendue 85'000 Euros Lors Des Enchères D'Alba

2024년 10월 03일

-

Fixing A Credit Report - Is Creating A Replacement Identity 100 % Legal?

2024년 10월 03일

-

10 Tax Tips To Reduce Costs And Increase Income

2024년 10월 03일

-

History Of This Federal Income Tax

2024년 10월 03일

-

When Is Often A Tax Case Considered A Felony?

2024년 10월 03일

-

The Philosophy Of Neo

2024년 10월 03일

-

The New Irs Whistleblower Reward Program Pays Millions For Reporting Tax Fraud

2024년 10월 03일

-

Details Of 2010 Federal Income Taxes

2024년 10월 03일

-

Pay 2008 Taxes - Some Questions About How Of Going About Paying 2008 Taxes

2024년 10월 03일

-

Découvrez La Sélection Truffes De Votre épicier - Grand Frais

2024년 10월 03일

-

Money For Binance Us

2024년 10월 03일

-

Why Improbable Be Private Tax Preparer?

2024년 10월 03일

-

A Tax Pro Or Diy Route - Which Is More Attractive?

2024년 10월 03일

-

How To Quickly Search And Find Text In PDF Files With FileViewPro

2024년 10월 03일

-

Annual Taxes - Humor In The Drudgery

2024년 10월 03일

-

History Of Your Federal Tax

2024년 10월 03일

-

Smart Income Tax Saving Tips

2024년 10월 03일

-

Pay 2008 Taxes - Some Questions In How Of Going About Paying 2008 Taxes

2024년 10월 03일

-

What Do You Do Whaen Your Bored?

2024년 10월 03일