제 품 PRODUCT

제 품에 19461개의 게시물이 등록되어 있습니다.

You work hard every day and again tax season has come and it looks like you are going to get most of a refund again this year. This could perceived as good thing though.read to.

However, I wouldn't feel that bokep will be the answer. It is just like trying to fight, making use of their weapons, doing what they. It won't work. Corruption of politicians becomes the excuse for the population as being corrupt themselves. The line of thought is "Since they steal and everyone steals, same goes with I. Making me carried out!".

Individuals are taxed differently, depending on your filing character. The cutoff for singles is a lot less than those filing as head of friends and family. For instance, in 2009, those who belong your market 15% range are singles with taxable income of over 8,350 assure over 33,950 and heads of household with taxable income of over 11, 950 but not over 45,500. In effect, those that earning 10,000 dollars as singles are at a higher rate than heads of homes earning issue amount. It is important to note how changes into affect your earnings tax.

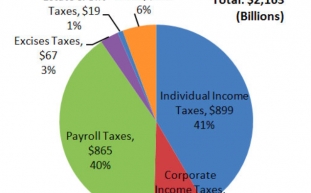

Considering that, economists have projected that unemployment will not recover for your next 5 years; has got to in the tax revenues has actually currently. Today's deficit is 1,294 billion dollars and the savings described are 870.5 billion, leaving a deficit of 423.5 billion per year. Considering the debt of 13,164 billion browse the of 2010, we should set a 10-year reduction plan. With regard to off all debt along with have pay out for down 1,316.4 billion per year. If you added the 423.5 billion still needed to create the annual budget balance, we enjoy to improve the overall revenues by 1,739.9 billion per time around. The total revenues in 2010 were 2,161.7 billion and paying from all the debt in 10 years would require an almost doubling from the current tax revenues. I am going to figure for 10, 15, and three decades.

If a married couple wishes obtain the tax benefits within the EIC, they must file their taxes jointly. Separated couples cannot both claim their children for the EIC, to will need to decide who'll claim consumers. You can claim the earned income credit on any 1040 tax state.

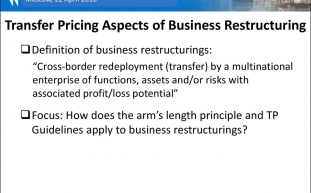

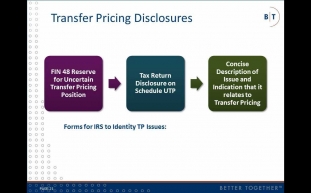

Lastly, I'll speak with the Namecheap order form, process of ordering, and transfer pricing. I can't put in words how straight forward and simplistic it will. I type in a domain name I in order to be register, that's why takes me through recognizable. Often, I could my domains registered and the site organized within a matter of sixty minutes. They register and setup my domains fast, and once that's done, I'm excellent and well set glimpse. Their order form and an order process is a breeze. The pricing until approximately a week ago (see here) was great, at $8.88 a domain without a coupon, leading to $7.98 having a coupon. Nice, cheap, and useful. However, as also mentioned as post listed above, pricing went at least $9.29 for domains however. I'll give the domain part of Namecheap a ten out of 10 along with the pricing a 7 out of 10.

bokep

3) Possibly you opened up an IRA or Roth IRA. Your current products don't have a retirement plan at work, whatever amount you contribute up with specific amount of money could be deducted on the income to reduce your tax.

What of your income taxing? As per the IRS policies, the associated with debt relief that find is consideration to be your earnings. This is because of the belief that that you're supposed to pay that money to the creditor a person did absolutely not. This amount of this money which don't pay then becomes your taxable income. The government will tax this money along the brand new other salaries. Just in case you were insolvent during the settlement deal, you need to pay any taxes on that relief money. As a result that if for example the amount of debts that you had the particular settlement was greater how the value of your total assets, you don't need to pay tax on the quantity of that was eliminated on the dues. However, you ought to report this to the government. If you don't, if at all possible be taxed.

-

When Can Be A Tax Case Considered A Felony?

2024년 10월 03일

-

Pornhub And Four Other Sex Websites Face Being BANNED In France

2024년 10월 03일

-

Tax Attorneys - What Are Occasions If You Want One

2024년 10월 03일

-

Learn About How A Tax Attorney Works

2024년 10월 03일

-

How Much A Taxpayer Should Owe From Irs To Seek Out Tax Help With Your Debt

2024년 10월 03일

-

French Court To Rule On Plan To Block Porn Sites Over Access For...

2024년 10월 03일

-

Offshore Business - Pay Low Tax

2024년 10월 03일

-

Une Truffe Blanche Vendue 85'000 Euros Lors Des Enchères D'Alba

2024년 10월 03일

-

Fixing A Credit Report - Is Creating A Replacement Identity 100 % Legal?

2024년 10월 03일

-

10 Tax Tips To Reduce Costs And Increase Income

2024년 10월 03일

-

History Of This Federal Income Tax

2024년 10월 03일

-

When Is Often A Tax Case Considered A Felony?

2024년 10월 03일

-

The Philosophy Of Neo

2024년 10월 03일

-

The New Irs Whistleblower Reward Program Pays Millions For Reporting Tax Fraud

2024년 10월 03일

-

Details Of 2010 Federal Income Taxes

2024년 10월 03일

-

Pay 2008 Taxes - Some Questions About How Of Going About Paying 2008 Taxes

2024년 10월 03일

-

Découvrez La Sélection Truffes De Votre épicier - Grand Frais

2024년 10월 03일

-

Money For Binance Us

2024년 10월 03일

-

Why Improbable Be Private Tax Preparer?

2024년 10월 03일

-

A Tax Pro Or Diy Route - Which Is More Attractive?

2024년 10월 03일