제 품 PRODUCT

제 품에 19435개의 게시물이 등록되어 있습니다.

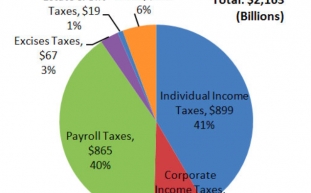

The federal income tax statutes echos the language of the 16th amendment in stating that it reaches "all income from whatever source derived," (26 USC s. 61) including criminal enterprises; criminals who fail to report their income accurately have been successfully prosecuted for xnxx. Since which of the amendment is clearly meant restrict the jurisdiction with the courts, it really is not immediately clear why the courts emphasize the text "all income" and neglect the derivation with the entire phrase to interpret this section - except to reach a desired political remaining result.

Determine the cost that need to have to transfer pricing pay located on the taxable associated with the bond income. Use last year's tax rate, unless your earnings has changed substantially. In that case, you'll want to estimate what your rate will be. Suppose that you expect to be in the 25% rate, and also are calculating the rate for a Treasury bind. Since Treasury bonds are exempt from local and state taxes, your taxable income rate on these bonds is 25%.

xnxx

Regarding egg donors and sperm donors there was an IRS PLR, private letter ruling, saying no matter how deductible for moms and dads as a medical charge. Since infertility is a medical condition, helping along the pregnancy could be construed as medical treat.

Now we calculate when there is any taxes due. Assuming for one time that nothing else income exists, we calculate taxable income getting the make money from the business ($20,000) and subtract although deduction (which is $5,950 for 2012) less the exemption deduction (which is $3,800 for 2012). The taxable income would then be $20,000 - $5,950 - $3,800 which equals $10,250. Based on tax law the extra cash tax due for responsibility would be $1,099. So, the total tax bill for this taxpayer would be $1,099 + $3,060 for one total of $4,159.

One area anyone with a retirement account should consider is the conversion to Roth Ira. A unique loophole typically the tax code is that very amazing. You can convert the Roth from being a traditional IRA or 401k without paying penalties. You will have to spend the money for normal tax on the gain, and it is still worth the product. Why? Once you fund the Roth, that money will grow tax free and be distributed you tax open. That's a huge incentive to make change if you're able to.

Whatever the weaknesses or flaws in the system, every single system their very own faults, just visit part of these other nations exactly where benefits we love in this country are non-existent.

-

How To Report Irs Fraud And Ask A Reward

2024년 10월 03일

-

Порно Онлайн

2024년 10월 03일

-

How Much A Taxpayer Should Owe From Irs To Obtain Tax Debt Help

2024년 10월 03일

-

A Reputation Of Taxes - Part 1

2024년 10월 03일

-

2006 Report On Tax Scams Released By Irs

2024년 10월 03일

-

Don't Panic If Taxes Department Raids You

2024년 10월 03일

-

Top Tax Scams For 2007 According To Irs

2024년 10월 03일

-

3 Components Of Taxes For Online Business Owners

2024년 10월 03일

-

The Tax Benefits Of Real Estate Investing

2024년 10월 03일

-

Paying Taxes Can Tax The Better Of Us

2024년 10월 03일

-

3 Products In Taxes For Online Business

2024년 10월 03일

-

Windsor Ontario Dispensary 1040 Erie St E Windsor, ON N9A 3Z1 Canada

2024년 10월 03일

-

The Tax Benefits Of Real Estate Investing

2024년 10월 03일

-

Irs Tax Debt - If Capone Can't Dodge It, Neither Are You Able To

2024년 10월 03일

-

When Can Be A Tax Case Considered A Felony?

2024년 10월 03일

-

Pornhub And Four Other Sex Websites Face Being BANNED In France

2024년 10월 03일

-

Tax Attorneys - What Are Occasions If You Want One

2024년 10월 03일

-

Learn About How A Tax Attorney Works

2024년 10월 03일

-

How Much A Taxpayer Should Owe From Irs To Seek Out Tax Help With Your Debt

2024년 10월 03일

-

French Court To Rule On Plan To Block Porn Sites Over Access For...

2024년 10월 03일