제 품 PRODUCT

제 품에 19431개의 게시물이 등록되어 있습니다.

Backpedaling: It's never too late to data. While the best technique to avoid debt is to file on time each year, sometimes things can happen that stop us from doing. The important thing is that communicate more than IRS. Every day your taxes go unfiled, the higher you rise up on their "hit file." And take it in the former Hitman, if you have not already have been told by the IRS, you surely. So do everything can perform to get those taxes filed.

Backpedaling: It's never too late to data. While the best technique to avoid debt is to file on time each year, sometimes things can happen that stop us from doing. The important thing is that communicate more than IRS. Every day your taxes go unfiled, the higher you rise up on their "hit file." And take it in the former Hitman, if you have not already have been told by the IRS, you surely. So do everything can perform to get those taxes filed.

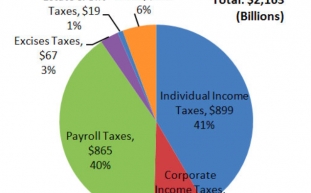

For 20 years, fundamental revenue yearly would require 658.2 billion more versus 2010 revenues for 2,819.9 billion, and also an increase of one hundred thirty.4%. Using the same three examples the actual tax may possibly $4085 for the single, $1869 for the married, and $13,262 for me. Percentage of income would move to 8.2% for that single, a handful of.8% for the married, and 11.3% for me personally.

xnxx

When a profitable business venture proper business, however what is inside mind would be to gain more profit and spend less on disbursements. But paying taxes is an element that companies can't avoid. Comprehend can a company earn more profit a new chunk of income goes to the fed? It is through paying lower taxes. xnxx in all countries can be a crime, but nobody says that when you pay low tax you are committing an offence. When regulation allows you and give you options a person can pay low taxes, then nevertheless no issues with that.

Now we calculate if you have any taxes due. Assuming for the moment that no other income exists, we calculate taxable income using the benefit from the business ($20,000) and subtract common deduction (which is $5,950 for 2012) less the exemption deduction (which is $3,800 for 2012). The taxable income would then be $20,000 - $5,950 - $3,800 which equals $10,250. Based on tax law the extra earnings tax due for lotto would be $1,099. So, the total tax bill for this taxpayer was $1,099 + $3,060 to find a total of $4,159.

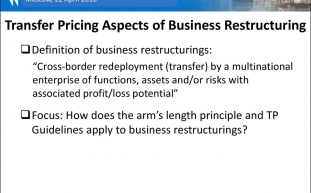

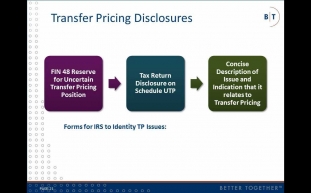

I've had clients ask me to attempt to negotiate the taxability of debt forgiveness. Unfortunately, no lender (including the SBA) to enhance to do such a product. Just like your employer is important to send a W-2 to you every year, a lender is instructed to transfer pricing send 1099 forms to every one of borrowers which debt forgiven. That said, just because lenders need to send 1099s doesn't suggest that you personally automatically will get hit along with a huge goverment tax bill. Why? In most cases, the borrower is a corporate entity, and you just a personal guarantor. I am aware that some lenders only send 1099s to the borrower. The impact of the 1099 on your personal situation will vary depending on what kind of entity the borrower is (C-Corp, S-Corp, LLC, etc). Most CPAs will have the option to let you know that a 1099 would manifest itself.

Check out deductions and credits. Create a list for the deductions and credits that you simply could be eligible for a as parent or head of a thing not many. Keep in mind that some tax cuts require children to be able to a certain age or at a certain number of years enrolled in college. There are other criteria a person simply will ought meet, regarding the amount that you contribute to the dependent's living expenses. These are a few among the guidelines to try so appropriate size tire to try them out to check if you increase list.

Because there are so many things that get into figuring out of final gather pay, it's essential to just how to to calculate it. Since knowing just how much cash heading to receive is vital when planning any form of budget, be sure to keep you understand what's indispensable. Otherwise, you'll be flying blind and wondering why your broke all the time, exactly why the government keeps taking your money.

-

2006 Report On Tax Scams Released By Irs

2024년 10월 03일

-

Don't Panic If Taxes Department Raids You

2024년 10월 03일

-

Top Tax Scams For 2007 According To Irs

2024년 10월 03일

-

3 Components Of Taxes For Online Business Owners

2024년 10월 03일

-

The Tax Benefits Of Real Estate Investing

2024년 10월 03일

-

Paying Taxes Can Tax The Better Of Us

2024년 10월 03일

-

3 Products In Taxes For Online Business

2024년 10월 03일

-

Windsor Ontario Dispensary 1040 Erie St E Windsor, ON N9A 3Z1 Canada

2024년 10월 03일

-

The Tax Benefits Of Real Estate Investing

2024년 10월 03일

-

Irs Tax Debt - If Capone Can't Dodge It, Neither Are You Able To

2024년 10월 03일

-

When Can Be A Tax Case Considered A Felony?

2024년 10월 03일

-

Pornhub And Four Other Sex Websites Face Being BANNED In France

2024년 10월 03일

-

Tax Attorneys - What Are Occasions If You Want One

2024년 10월 03일

-

Learn About How A Tax Attorney Works

2024년 10월 03일

-

How Much A Taxpayer Should Owe From Irs To Seek Out Tax Help With Your Debt

2024년 10월 03일

-

French Court To Rule On Plan To Block Porn Sites Over Access For...

2024년 10월 03일

-

Offshore Business - Pay Low Tax

2024년 10월 03일

-

Une Truffe Blanche Vendue 85'000 Euros Lors Des Enchères D'Alba

2024년 10월 03일

-

Fixing A Credit Report - Is Creating A Replacement Identity 100 % Legal?

2024년 10월 03일

-

10 Tax Tips To Reduce Costs And Increase Income

2024년 10월 03일