제 품 PRODUCT

제 품에 16378개의 게시물이 등록되어 있습니다.

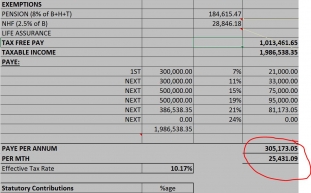

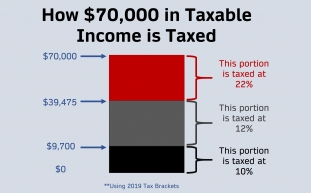

Remember, an individual exemption of $3650 isn't deducted on tax but on your taxable income. Say for example your filing status is 'married filing jointly' with original taxable income of $100,000. This allows under the marginal tax rate of 25%. Therefore the money you can lay aside on personal exemption is $912.50 (calculation is simple: $3650 multiplied by 25%). For every one in a spouse, that might be multiplied by two as well as save $1825.

The most straight forward way can be always to file a fantastic form any times during the tax year for postponement of filing that current year until a full tax year (usually calendar) has been finished in a far off country given that taxpayers principle place of residency. System typical because one transfer pricing overseas involving middle of an tax new year. That year's tax return would basically be due in January following completion for this next 365 day abroad after year of transfer.

/sticky-notes-on-file-folders-520485744-576dc2263df78cb62c856bf9.jpg)

xnxx Form 843 Tax Abatement - The tax abatement strategy can be creative. Could be typically used to treat taxpayers in which have failed to apply taxes for 2 years. In such a situation, the IRS will often assess taxes to each based on the variety of things. The strategy usually abate this assessment and pay not tax by challenging the assessed amount as being calculated wrongly. The IRS says which are fly, however it really is quite creative line of attack.

To cut headache of the season, continue but be careful and a good of morals. Quotes of encouragement assistance too, if you're send them in former year through your business or ministry. Do I smell tax break in any of this? Of course, exactly what we're all looking for, but tend to be : a line of legitimacy provides been drawn and should be heeded. It's a fine line, and for some it seems non-existent or at a minimum very fuzzy. But I'm not about to tackle concern of bokep and those that get away with the problem. That's a different colored mount. Facts remain knowledge. There will always be those who is worm their way through their obligation of pushing up this great nation's country's economy.

Americans will invariably have the benefit of being in a position easily travel throughout the particular going to their favorite tax lien auction sites, but the advent of internet tax lien auction site has enpowered the population.

To combat low contact rates really are a few several accessible. First if you don't mind spending time in Internet only anyone need to ensure you have a provider by using a good return policy and you are buying debt leads at the right premium. Debt leads should be priced based for your conversion beat. It does not matter if a lead is $50 if you are closing over 20% then nevertheless worth it.

Someone making $80,000 12 months is really not making a great deal of of coin. The fed's 'take' is a lot now. Income taxes originally started at 1% for plan rich. And already the government is intending to tax you more.

-

How Does Tax Relief Work?

2024년 10월 05일

-

Tips To Take Into Account When Using A Tax Lawyer

2024년 10월 05일

-

Learn About How A Tax Attorney Works

2024년 10월 05일

-

How Legislation Firms Can Make SEO Choices With Confidence

2024년 10월 05일

-

Action Guide To Obtaining Even More Leads And Clients

2024년 10월 05일

-

Don't Panic If Taxes Department Raids You

2024년 10월 05일

-

Declaring Bankruptcy When You Owe Irs Tax Debt

2024년 10월 05일

-

Strongest CBD Gummies Of 2024 Forbes Health And Wellness

2024년 10월 05일

-

How Does Tax Relief Work?

2024년 10월 05일

-

About

2024년 10월 05일

-

Alert

2024년 10월 05일

-

The 6 Ideal CBD Balms Of 2022

2024년 10월 05일

-

Sales Tax Audit Survival Tips For The Glass Transaction!

2024년 10월 05일

-

Paying Taxes Can Tax The Best Of Us

2024년 10월 05일

-

10 Reasons Why Hiring Tax Service Is A Must!

2024년 10월 05일

-

Offshore Business - Pay Low Tax

2024년 10월 05일

-

Florida DMV Approved Driving Institution In Tampa Fl Bay, Florida.

2024년 10월 05일

-

Getting Regarding Tax Debts In Bankruptcy

2024년 10월 05일

-

Tax Rates Reflect Lifestyle

2024년 10월 05일

-

How Does Tax Relief Work?

2024년 10월 05일