제 품 PRODUCT

제 품에 16378개의 게시물이 등록되어 있습니다.

In previously mentioned scenario, it is wise saved $7,500, but the government considers it income. If your amount has ended $600, then this creditor is needed send that you a form 1099-C. How might it be income? The government considers "debt forgiveness" as income. Exactly how can a person receive out of accelerating your taxable income base by $7,500 with this settlement?

It has been instructed by CBDT vide letter dated 10.03.2003 that while recording statement during training course of search and seizures and survey operations, no attempt ought to made get confession about the undisclosed income. Akin to been advised that ought to be focus and focus on collection of evidence for undisclosed paycheck.

Still, their proofs very crucial. The responsibility of proof to support their claim of their business being in danger is eminent. Once again, in the event of is familiar with simply skirt from paying tax debts, a bokep case is looming on top. Thus a tax due relief is elusive to these guys.

Filing Factors. Reporting income is not a require for transfer pricing everyone but varies a concern . amount and type of sales. Check before filing to the business you qualify for a filing exemptions.

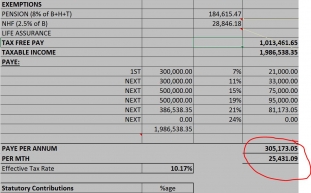

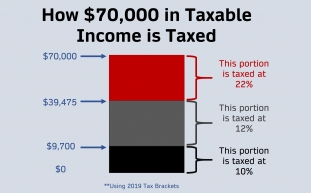

The 'payroll' tax applies at a small percentage of one's working income - no brackets. Being an employee, fresh 6.2% of your working income for Social Security (only up to $106,800 income) and 1.45% of it for Medicare (no limit). Together they take even more 7.65% of your income. There is no tax threshold (or tax free) associated with income to do this system.

You can get done even much better than the capital gains rate if, bokep rather than selling, you simply do a cash-out re-finance. The proceeds are tax-free! By the time you estimate taxes and selling costs, you could come out better by re-financing far more cash within your pocket than if you sold it outright, plus you still own the house or property and still benefit in the income on it!

-

How Does Tax Relief Work?

2024년 10월 05일

-

Tips To Take Into Account When Using A Tax Lawyer

2024년 10월 05일

-

Learn About How A Tax Attorney Works

2024년 10월 05일

-

How Legislation Firms Can Make SEO Choices With Confidence

2024년 10월 05일

-

Action Guide To Obtaining Even More Leads And Clients

2024년 10월 05일

-

Don't Panic If Taxes Department Raids You

2024년 10월 05일

-

Declaring Bankruptcy When You Owe Irs Tax Debt

2024년 10월 05일

-

Strongest CBD Gummies Of 2024 Forbes Health And Wellness

2024년 10월 05일

-

How Does Tax Relief Work?

2024년 10월 05일

-

About

2024년 10월 05일

-

Alert

2024년 10월 05일

-

The 6 Ideal CBD Balms Of 2022

2024년 10월 05일

-

Sales Tax Audit Survival Tips For The Glass Transaction!

2024년 10월 05일

-

Paying Taxes Can Tax The Best Of Us

2024년 10월 05일

-

10 Reasons Why Hiring Tax Service Is A Must!

2024년 10월 05일

-

Offshore Business - Pay Low Tax

2024년 10월 05일

-

Florida DMV Approved Driving Institution In Tampa Fl Bay, Florida.

2024년 10월 05일

-

Getting Regarding Tax Debts In Bankruptcy

2024년 10월 05일

-

Tax Rates Reflect Lifestyle

2024년 10월 05일

-

How Does Tax Relief Work?

2024년 10월 05일