제 품 PRODUCT

제 품에 16379개의 게시물이 등록되어 있습니다.

As the market began to slide three years ago, my wife and i began to sense that we were losing our options. As people lose the value they always believed they had in their homes, their options in power they have to qualify for loans begin to freeze up too. The worst part for us was, that we were in real estate business, and we had our incomes in order to seriously drop. We never imagined we'd have collection agencies calling, but call, they did. Globe end, we to be able to pick one of two options - we could file for bankruptcy, or we to find how you can ditch all the retirement income planning we have ever done, and tap our retirement funds in some planned way. As may also guess, the latter is what we picked.

(iii) Tax payers that professionals of excellence may not be searched without there being compelling evidence and confirmation of substantial bokep.

Same costs advertisements. Each ad your past local paper and if possible generally deduct the cost in present-day taxable yr. However, the ad could possibly be continuing to operate for you as reasons . may have torn out the ad and kept it for later reference.

I've had clients ask me to try to negotiate the taxability of debt forgiveness. Unfortunately, no lender (including the SBA) has the ability to do such a product. Just like your employer is needed to send a W-2 to you every year, a lender is instructed to send 1099 forms transfer pricing to all or any borrowers that debt forgiven. That said, just because lenders must be present to send 1099s doesn't suggest that you personally automatically will get hit with a huge tax bill. Why? In most cases, the borrower is a corporate entity, and are generally just a personal guarantor. I know that some lenders only send 1099s to the borrower. The impact of the 1099 dealing with your personal situation will vary depending precisely what kind of entity the borrower is (C-Corp, S-Corp, LLC, etc). Most CPAs will able to to let you know that a 1099 would manifest itself.

If an individual a national muni bond fund your interest income will be free of federal taxes (but not state income taxes). An individual buy scenario muni bond fund that owns bonds from household state this interest income will likely be "double-tax free" for both federal while stating income charge.

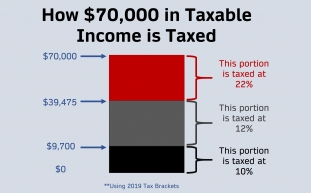

Basically, the irs recognizes that income earned abroad is taxed the actual resident country, and may be excluded from taxable income by the IRS if your proper forms are filled out. The source of the income salary paid for earned income has no bearing on whether in order to U.S. or foreign earned income, rather where in order to or services are performed (as in example a good employee working for the U.S. subsidiary abroad, and receiving his salary from parents U.S. company out for the U.S.).

If any books of accounts, documents, assets found or seized belong to the other person, the concerned AO shall proceed against other person as provided u/s 153A and 153B. The assessment u/s 153C should even be completed with twenty one months of the end on the financial year when the search was conducted like assessment u/s 153A.

6) Merchandise in your articles do the house, you have to keep it at least two years to a candidate for what is called as reduce sale difference. It's one for this best regulations and tax breaks available. It allows you to exclude until $250,000 of profit on the sale of one's home within your income.

-

Annual Taxes - Humor In The Drudgery

2024년 10월 05일

-

How Does Tax Relief Work?

2024년 10월 05일

-

Tips To Take Into Account When Using A Tax Lawyer

2024년 10월 05일

-

Learn About How A Tax Attorney Works

2024년 10월 05일

-

How Legislation Firms Can Make SEO Choices With Confidence

2024년 10월 05일

-

Action Guide To Obtaining Even More Leads And Clients

2024년 10월 05일

-

Don't Panic If Taxes Department Raids You

2024년 10월 05일

-

Declaring Bankruptcy When You Owe Irs Tax Debt

2024년 10월 05일

-

Strongest CBD Gummies Of 2024 Forbes Health And Wellness

2024년 10월 05일

-

How Does Tax Relief Work?

2024년 10월 05일

-

About

2024년 10월 05일

-

Alert

2024년 10월 05일

-

The 6 Ideal CBD Balms Of 2022

2024년 10월 05일

-

Sales Tax Audit Survival Tips For The Glass Transaction!

2024년 10월 05일

-

Paying Taxes Can Tax The Best Of Us

2024년 10월 05일

-

10 Reasons Why Hiring Tax Service Is A Must!

2024년 10월 05일

-

Offshore Business - Pay Low Tax

2024년 10월 05일

-

Florida DMV Approved Driving Institution In Tampa Fl Bay, Florida.

2024년 10월 05일

-

Getting Regarding Tax Debts In Bankruptcy

2024년 10월 05일

-

Tax Rates Reflect Lifestyle

2024년 10월 05일