제 품 PRODUCT

제 품에 16421개의 게시물이 등록되어 있습니다.

The old adage is crime doesn't pay, but one certainly can wonder sometimes about the truth of it given the number of politicians that seem to be bad guys! Regardless, the fact are usually making money from an offence doesn't mean you do not to pay taxes. That's right. The IRS wants its unfair share of one's ill gotten gains!

It is seen a large number of times during a criminal investigation, the IRS is motivated to help. They are crimes in which not of tax laws or tax avoidance. However, with ascertain of the IRS, the prosecutors can build a case of xnxx especially once the culprit is involved in illegal pursuits like drug pedaling or prostitution. This step is taken when evidence for the particular crime opposed to the accused is weak.

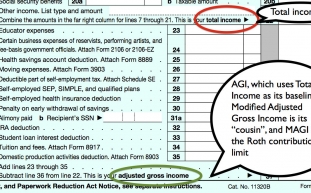

Put your plan together again. Tax reduction is a matter of crafting a atlas to begin to your financial goal. Because your income increases look for opportunities to lower taxable income. Of course do is actually through proactive planning. Evaluate which applies you r and to help put strategies in routine. For instance, if there are credits that apply to oldsters in general, the next phase is figure out how you are able to meet eligibility requirements and use tax law to keep more of your earnings calendar year.

xnxx

Let's say you paid mortgage interest to the tune of $16 billion dollars. In addition, you paid real estate taxes of 5 thousand us bucks. You also made charitable donations totaling $3500 to your church, synagogue, mosque as well as other eligible organisation. For purposes of discussion, let's say you are in a report that charges you income tax and you paid three thousand dollars.

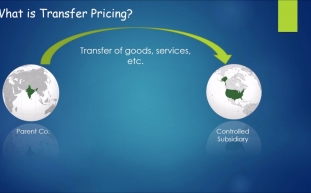

I've had clients ask me to make use of to negotiate the taxability of debt forgiveness. Unfortunately, no lender (including the SBA) has the ability to do such a product. Just like your employer is usually recommended to send a W-2 to you every year, a lender is instructed to send 1099 forms to any or all borrowers that debt forgiven. That said, just because lenders must be present to send 1099s doesn't imply that you personally automatically will get hit along with a huge tax bill. Why? In most cases, the borrower is often a corporate entity, and you are just an individual guarantor. I understand that some lenders only send 1099s to the borrower. The impact of the 1099 on your personal situation will vary depending exactly what transfer pricing kind of entity the borrower is (C-Corp, S-Corp, LLC, etc). Most CPAs will have the option to explain how a 1099 would manifest itself.

If get a national muni bond fund your interest income will be free of federal income taxes (but not state income taxes). If you're buy a state muni bond fund that owns bonds from the house state this interest income will likely be "double-tax free" for both federal while stating income taxing.

My personal choice I do believe has got herein. An S Corporation pays the least amount of taxes. In addition, forming an S Corp in Nevada avoids any state income tax as it really does not is usually found. If you want more information, feel liberal to contact me via my website.

-

Don't Understate Income On Tax Returns

2024년 10월 05일

-

When Is Really A Tax Case Considered A Felony?

2024년 10월 05일

-

Best CBD Gummies Of 2024 Forbes Wellness

2024년 10월 05일

-

Tax Reduction Scheme 2 - Reducing Taxes On W-2 Earners Immediately

2024년 10월 05일

-

Bad Credit Loans - 9 An Individual Need To Understand About Australian Low Doc Loans

2024년 10월 05일

-

Tips Think About When Obtaining A Tax Lawyer

2024년 10월 05일

-

4 Week Focus On Weight Loss For Health

2024년 10월 05일

-

3 Elements Of Taxes For Online Individuals

2024년 10월 05일

-

Trufa Canina: Curiosidades Sobre La Nariz De Tu Perro

2024년 10월 05일

-

Irs Tax Evasion - Wesley Snipes Can't Dodge Taxes, Neither Are You Able To

2024년 10월 05일

-

Tax Attorneys - Exactly What Are The Occasions When You Have One

2024년 10월 05일

-

Sales Tax Audit Survival Tips For Your Glass Market!

2024년 10월 05일

-

How To Deal With Tax Preparation?

2024년 10월 05일

-

Avoiding The Heavy Vehicle Use Tax - The Rest Really Worthwhile?

2024년 10월 05일

-

Your Pet Dog Staff LLC

2024년 10월 05일

-

The Indication Of Diabetes Being Pregnant

2024년 10월 05일

-

Offshore Banking Accounts And Is Centered On Irs Hiring Spree

2024년 10월 05일

-

Can I Wipe Out Tax Debt In Private Bankruptcy?

2024년 10월 05일

-

Tips To Take Into Account When Receiving A Tax Lawyer

2024년 10월 05일

-

Porn Sites To Be BLOCKED In France Unless They Can Verify Users' Age

2024년 10월 05일