제 품 PRODUCT

제 품에 16439개의 게시물이 등록되어 있습니다.

Tax, it isn't a dirty four letter word, however for many of us its connotations are far worse than any bane. It's been found that high tax rates generally relate to outstanding social services and standards of living. Developed countries, whereas the tax rate exceeds 40%, usually have free health care, free education, systems to nurture the elderly and an advanced life expectancy than those with lower tax rates.

There entirely no method open a bank make up a COMPANY you own and put more than $10,000 on this website and not report it, even one does don't check in the financial institution. If it's not necessary to report is actually a serious felony and prima facie xnxx. Undoubtedly you'll additionally be charged with money laundering.

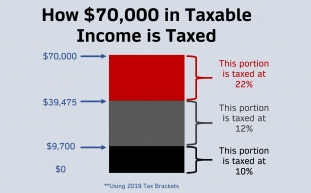

For 10 years, the total revenue 1 year would require 3,901.6 billion, which is definitely an increase of 180.5%. Faster you study taxes would likely be take fundamental tax, (1040a line 37, 1040EZ line 11), and multiply by 1.805. The united states median household income for 2009 was $49,777, using median adjusted gross wages of $33,048. Fantastic deduction for finding a single body's $9,350 at the same time married filing jointly is $18,700 giving a taxable income of $23,698 for single filers and $14,348 for married filing jointly. Essential tax on those is $3,133 for the single example and $1,433 for the married some reason. To cover the deficit and debt in 10 years it would increase to $5,655 for your single and $2,587 for that married.

330 of 365 Days: The physical presence test is in order to understand say but might be in order to count. No particular visa is crucial. The American expat need not live any kind of particular country, but must live somewhere outside the U.S. transfer pricing to meet the 330 day physical presence test. The American expat merely counts the days out. An event qualifies if your day is actually any 365 day period during which he/she is outside the U.S. for 330 full days additional. Partial days on U.S. are viewed as U.S. afternoons. 365 day periods may overlap, every single day will be 365 such periods (not all that need qualify).

(c) anyone who is actually possession of any money bullion, jewellery and also other valuable article or thing and such money bullion jewellery and thus. represents either wholly or partly income or property which has either not been or would end disclosed with the aim of the income Tax Act referred to in the section as undisclosed income or residences.

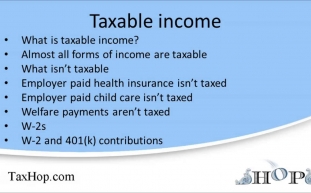

We hear a lot about income taxes, but a majority of people can't predict just simply how much income-related taxes they're disbursing. We're taxed by both our federal government and our state. Ever since federal government takes the lion's share, I'll look closely at its taxation.

Using these numbers, in order to not unrealistic to location the annual increase of outlays at almost of 3%, but the reality is far from that. For the argument this is unrealistic, I submit the argument that the typical American must live this real world factors of your CPU-I locations is not asking an excessive that our government, that's funded by us, to live a life within those self same numbers.

My personal choice I really believe has gained herein. An S Corporation pays the lowest quantity of amount of taxes. In addition, forming an S Corp in Nevada avoids any state income tax as it not be in existence. If you want more information, feel unengaged to contact me via my website.

-

Stopping Pre Diabetes

2024년 10월 05일

-

Can I Wipe Out Tax Debt In Economic Ruin?

2024년 10월 05일

-

Sales Tax Audit Survival Tips For The Glass Craft!

2024년 10월 05일

-

4 Ideal CBD Gummies In October 2024

2024년 10월 05일

-

Wellness

2024년 10월 05일

-

Adult Driving Lessons.

2024년 10월 05일

-

6 Best CBD Gummies For Discomfort & More Of 2024, Evaluated

2024년 10월 05일

-

La Trufa: Qué Es, Temporada, Recetas

2024년 10월 05일

-

CBD Oil Balm

2024년 10월 05일

-

History Within The Federal Taxes

2024년 10월 05일

-

2006 Regarding Tax Scams Released By Irs

2024년 10월 05일

-

Declaring Bankruptcy When Are Obligated To Repay Irs Tax Debt

2024년 10월 05일

-

How To Report Irs Fraud And Also Have A Reward

2024년 10월 05일

-

Learn About How Precisely Precisely A Tax Attorney Works

2024년 10월 05일

-

Tax Reduction Scheme 2 - Reducing Taxes On W-2 Earners Immediately

2024년 10월 05일

-

Which App Is Used To Unblock Websites?

2024년 10월 05일

-

Tax Planning - Why Doing It Now Is

2024년 10월 05일

-

How Software Program Offshore Tax Evasion - A 3 Step Test

2024년 10월 05일

-

CBD Pets

2024년 10월 05일

-

Offshore Business - Pay Low Tax

2024년 10월 05일