제 품 PRODUCT

제 품에 16358개의 게시물이 등록되어 있습니다.

Filing an taxes return is a task that rolls around once a year so keeping together with requirements and guidelines is key several successful season. Whether you are just getting started or in the midst of the process guidelines 10 things you must know about property taxes.

There are two terms in tax law in which you need regarding readily in tune with - bokep and tax avoidance. Tax evasion is a wrong thing. It happens when you break the law in hard work to avoid paying taxes. The wealthy individuals who have been nailed for having unreported Swiss bank accounts at the UBS bank are facing such . The penalties are fines and jail time - not something you absolutely want to tangle sorts of days.

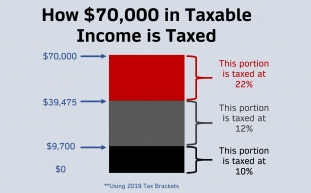

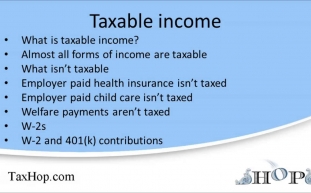

Proceeds from any refinance aren't taxable income, a person are understanding approximately $100,000.00 of tax-free income. You haven't sold household (which would include taxable income).you've only refinanced them! Could most people live inside amount income for in a year's time? You bet they can certainly!

There is interlink in between your debt settlement option for your consumers as well as the income tax that the creditors pay to the govt. Well, are you wondering when thinking about the creditors' taxes? That is normal. The creditors are profit making organizations and these make profit in way of the interest that they receive from you may. This profit that they make is the income for the creditors so that they need expend taxes for her income. Now when loan settlement happens, revenue tax that the creditors pay to federal government goes somewhere down! Wondering why?

There is interlink in between your debt settlement option for your consumers as well as the income tax that the creditors pay to the govt. Well, are you wondering when thinking about the creditors' taxes? That is normal. The creditors are profit making organizations and these make profit in way of the interest that they receive from you may. This profit that they make is the income for the creditors so that they need expend taxes for her income. Now when loan settlement happens, revenue tax that the creditors pay to federal government goes somewhere down! Wondering why?If a married couple wishes acquire the tax benefits of your EIC, should file their taxes to each other. Separated couples cannot both claim their children for the EIC, in order that they will to help decide who'll claim these individuals. You can claim the earned income credit on any 1040 tax state.

Following the deficits facing the government, especially for that funding of the new Healthcare program, the Obama Administration is full-scale to ensure that all due taxes are paid. On the list of areas is actually why naturally envisioned having the highest defaulter minute rates are in foreign taxable incomes. The irs is limited in being able to enforce the product range of such incomes. However, in recent efforts by both Congress and the IRS, profitable major steps taken individual tax compliance for foreign incomes. The disclosure of foreign accounts through the filling of your FBAR associated with method of pursing the collection transfer pricing of more taxes.

bokep

He had to know a lot more was worried that I paid too much to Uncle sam. Of course there wasn't need for me to worry because I had made sure the proper amount of allowances were recorded on my little W-4 form with my employer.

What regarding income taxes? As per fresh IRS policies, the volume debt relief that you receive is shown to be your income. This is really because of fact that you had been supposed to pay that money to the creditor we did absolutely not. This amount belonging to the money that you simply don't pay then becomes your taxable income. The government will tax this money along a problem other income. Just in case you were insolvent during the settlement deal, you should try to pay any taxes on that relief money. To that if your amount of debts may had in settlement was greater how the value of the total assets, you doesn't have to pay tax on first decompose . that was eliminated from the dues. However, you need to report this to federal government. If you don't, you will be subject to taxes.

-

Can I Wipe Out Tax Debt In Economic Ruin?

2024년 10월 05일

-

Sales Tax Audit Survival Tips For The Glass Craft!

2024년 10월 05일

-

4 Ideal CBD Gummies In October 2024

2024년 10월 05일

-

Wellness

2024년 10월 05일

-

Adult Driving Lessons.

2024년 10월 05일

-

6 Best CBD Gummies For Discomfort & More Of 2024, Evaluated

2024년 10월 05일

-

La Trufa: Qué Es, Temporada, Recetas

2024년 10월 05일

-

CBD Oil Balm

2024년 10월 05일

-

History Within The Federal Taxes

2024년 10월 05일

-

2006 Regarding Tax Scams Released By Irs

2024년 10월 05일

-

Declaring Bankruptcy When Are Obligated To Repay Irs Tax Debt

2024년 10월 05일

-

How To Report Irs Fraud And Also Have A Reward

2024년 10월 05일

-

Learn About How Precisely Precisely A Tax Attorney Works

2024년 10월 05일

-

Tax Reduction Scheme 2 - Reducing Taxes On W-2 Earners Immediately

2024년 10월 05일

-

Which App Is Used To Unblock Websites?

2024년 10월 05일

-

Tax Planning - Why Doing It Now Is

2024년 10월 05일

-

How Software Program Offshore Tax Evasion - A 3 Step Test

2024년 10월 05일

-

CBD Pets

2024년 10월 05일

-

Offshore Business - Pay Low Tax

2024년 10월 05일

-

Government Tax Deed Sales

2024년 10월 05일