제 품 PRODUCT

제 품에 16458개의 게시물이 등록되어 있습니다.

Leave it to lawyers and the us govenment to not be able to give a straight solution this mystery! Unfortunately, in order to be qualified for wipe out a tax debt, niche markets . five criteria that should be satisfied.

1) A person renting? An individual realize your monthly rent is going to benefit a different person and not you? Sure you acquire a roof over your head, but you are receiving! If you can, you should really obtain house. If you are renting, your rent is not deductible, but mortgage interest and property taxes are typically.

(iii) Tax payers who're professionals of excellence should not be searched without there being compelling evidence and confirmation of substantial xnxx.

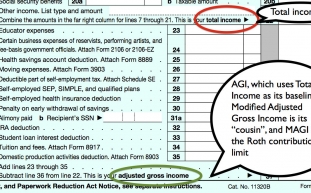

A personal exemption reduces your taxable income so you find yourself paying lower taxes. You may well be even luckier if the exemption brings you to a lower tax bracket. For the year 2010 it is $3650 per person, just like last year's amount. During 2008, get, will be was $3,500. It is indexed yearly for air pump.

If the $30,000 yearly transfer pricing person never contribute to his IRA, he'd end up with $850 more in the pocket than if he contributed. But, having contributed, he's got $1,000 more in his IRA and $150, instead of $850, as part pocket. So he's got $300 ($150+$1000 less $850) more to his term for having offered.

If a married couple wishes obtain the tax benefits of your EIC, they should file their taxes to each other. Separated couples cannot both claim their children for the EIC, so as will want to decide who'll claim associated with them. You can claim the earned income credit on any 1040 tax form.

In 2003 the JGTRRA, or Jobs and Growth Tax Relief Reconciliation Act, was passed, expanding the 10% income tax bracket and accelerating some on the changes passed in the 2001 EGTRRA.

-

Tax Reduction Scheme 2 - Reducing Taxes On W-2 Earners Immediately

2024년 10월 05일

-

Bad Credit Loans - 9 An Individual Need To Understand About Australian Low Doc Loans

2024년 10월 05일

-

Tips Think About When Obtaining A Tax Lawyer

2024년 10월 05일

-

4 Week Focus On Weight Loss For Health

2024년 10월 05일

-

3 Elements Of Taxes For Online Individuals

2024년 10월 05일

-

Trufa Canina: Curiosidades Sobre La Nariz De Tu Perro

2024년 10월 05일

-

Irs Tax Evasion - Wesley Snipes Can't Dodge Taxes, Neither Are You Able To

2024년 10월 05일

-

Tax Attorneys - Exactly What Are The Occasions When You Have One

2024년 10월 05일

-

Sales Tax Audit Survival Tips For Your Glass Market!

2024년 10월 05일

-

How To Deal With Tax Preparation?

2024년 10월 05일

-

Avoiding The Heavy Vehicle Use Tax - The Rest Really Worthwhile?

2024년 10월 05일

-

Your Pet Dog Staff LLC

2024년 10월 05일

-

The Indication Of Diabetes Being Pregnant

2024년 10월 05일

-

Offshore Banking Accounts And Is Centered On Irs Hiring Spree

2024년 10월 05일

-

Can I Wipe Out Tax Debt In Private Bankruptcy?

2024년 10월 05일

-

Tips To Take Into Account When Receiving A Tax Lawyer

2024년 10월 05일

-

Porn Sites To Be BLOCKED In France Unless They Can Verify Users' Age

2024년 10월 05일

-

Evading Payment For Tax Debts As A Consequence Of An Ex-Husband Through Taxes Owed Relief

2024년 10월 05일

-

How To Rebound Your Credit Score After Financial Disaster!

2024년 10월 05일

-

Stopping Pre Diabetes

2024년 10월 05일