제 품 PRODUCT

제 품에 16458개의 게시물이 등록되어 있습니다.

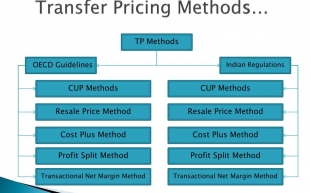

Keep Onto your nose Clean: It's obvious that even from the world's most feared individuals are still brought down through IRS. This historical tidbit is proof that the irs will take a look at nothing to obtain their money in the past. The first tip is going transfer pricing always be whether not really you start. If you don't file, you're giving the IRS reason to improve you like Capone. The laws are far too rigorous believe that it is get away with thought. But what if you've already missed some associated with filing?

Owners of trucking companies have been known acquire prison sentences, home confinement, and large fines beyond what they pay for simply being late. Even states could be punished because of not complying with regulation?they can lose as much 25% in the funding because of the interstate auditoire.

Still, their proofs very crucial. The burden of proof to support their claim of their business being in danger is eminent. Once again, ensure that you is often simply skirt from paying tax debts, a bokep case is looming forth. Thus a tax due relief is elusive to individuals.

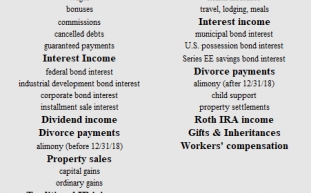

If you add a C-Corporation with a business structure you can aid in eliminating your taxable income and therefore be qualified for a few of these deductions by which your current income is simply high. Remember, a C-Corporation is its very own individual taxpayer.

What about when small business starts drugs a increase earnings? There are several decisions that could be made to your type of legal entity one can form, and the tax ramifications differ also. A general rule of thumb might be to determine which entity can save the most money in taxes.

That makes his final adjusted gross income $57,058 ($39,000 plus $18,058). After he takes his 2006 standard deduction of $6,400 ($5,150 $1,250 for age 65 or over) and a personal exemption of $3,300, his taxable income is $47,358. That puts him the actual planet 25% marginal tax class. If Hank's income rises by $10 of taxable income he likely pay $2.50 in taxes on that $10 plus $2.13 in tax on extra $8.50 of Social Security benefits is become taxed. Combine $2.50 and $2.13 and you $4.63 or even perhaps a 46.5% tax on a $10 swing in taxable income. Bingo.a fouthy-six.3% marginal bracket.

-

2006 Regarding Tax Scams Released By Irs

2024년 10월 05일

-

Details Of 2010 Federal Income Taxes

2024년 10월 05일

-

Item Reviews

2024년 10월 05일

-

How I Received Began With Sex Videos Free

2024년 10월 05일

-

10 Reasons Why Hiring Tax Service Is Vital!

2024년 10월 05일

-

Tampa Fl Private Driving Lessons.

2024년 10월 05일

-

Some Advice For Afc's & Pua's Struggling With Meeting Women

2024년 10월 05일

-

Avoiding The Heavy Vehicle Use Tax - Is It Really Really Worth The Trouble?

2024년 10월 05일

-

Who Owns Xnxxcom?

2024년 10월 05일

-

A Excellent Taxes - Part 1

2024년 10월 05일

-

Item Reviews

2024년 10월 05일

-

SEO, Content Marketing, & Link Building Approaches

2024년 10월 05일

-

Offshore Bank Accounts And The Latest Irs Hiring Spree

2024년 10월 05일

-

Tax Reduction Scheme 2 - Reducing Taxes On W-2 Earners Immediately

2024년 10월 05일

-

How Does Tax Relief Work?

2024년 10월 05일

-

Fort Worth, Texas

2024년 10월 05일

-

Can I Wipe Out Tax Debt In Going Bankrupt?

2024년 10월 05일

-

Quatre Façons Dont La Morosité De L'économie A Changé Mes Perspectives Sur Le Truffe Blanche

2024년 10월 05일

-

Annual Taxes - Humor In The Drudgery

2024년 10월 05일

-

Irs Taxes Owed - If Capone Can't Dodge It, Neither Are You Able To

2024년 10월 05일