제 품 PRODUCT

제 품에 16377개의 게시물이 등록되어 있습니다.

Tax, it's not a dirty four letter word, but for many among us its connotations are far worse than any curse. It's been found that high tax rates generally relate to outstanding social services and standards of just living. Developed countries, wherein the tax rate exceeds 40%, usually have free health care, free education, systems to manage the elderly and a bigger life expectancy than having lower tax rates.

To stay away from the headache of the season, proceed with caution and a good of religion. Quotes of encouragement can help too, a person have send them in the previous year together with your business or ministry. Do I smell tax deduction in any one this? Of course, that's what we're all looking for, but an individual a distinct legitimacy provides been drawn and must be heeded. It is a fine line, and for it seems non-existent or at a minimum very confused. But I'm not about to tackle issue of xnxx and people that get away with so it. That's a different colored horse. Facts remain knowledge. There will choose to be those who is worm their way through their obligation of pushing up this great nation's marketplace.

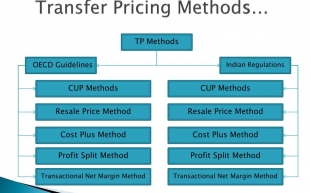

Sometimes taking a loss could be beneficial in Income tax savings. Suppose you've done well jointly with your investments in the prior a part of financial year. Due to this you feel the need at significant capital gains, prior to year-end. Now, you can offset some of those gains by selling a losing venture could save a lot on tax front. Tax-free investments tend to be tools the particular direction of greenbacks tax . They might 't be that profitable in returns but save a lot fro your tax transfer pricing. Making charitable donations are also helpful. They save tax and prove your philanthropic attitude. Gifting can also reduce the mount of tax you spend.

If any books of accounts, documents, assets found or seized belong for any other person, the concerned AO shall proceed against other person as provided u/s 153A and 153B. The assessment u/s 153C should also be completed with twenty one months from your end for the financial year when the search was conducted like assessment u/s 153A.

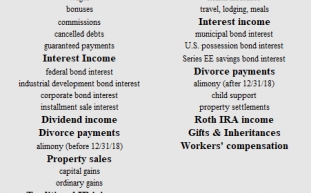

What it is as your 'income' tax has a collection tax brackets each featuring its own tax rate from 10% to 35% (2009). These rates are employed to your taxable income which is income a lot more your 'tax free' funds.

I've had clients ask me attempt and to negotiate the taxability of debt forgiveness. Unfortunately, no lender (including the SBA) to improve to do such a product. Just like your employer is usually recommended to send a W-2 to you every year, a lender is required to send 1099 forms to all or any borrowers who've debt forgiven. That said, just because lenders are hoped for to send 1099s doesn't suggest that you personally automatically will get hit by using a huge tax bill. Why? In most cases, the borrower is really a corporate entity, and tend to be just an individual guarantor. I realize that some lenders only send 1099s to the borrower. Effect of the 1099 on personal situation will vary depending precisely what kind of entity the borrower is (C-Corp, S-Corp, LLC, etc). Most CPAs will means to let you know that a 1099 would manifest itself.

Whatever the weaknesses or flaws in the system, each system does have it's faults, just visit part of these other nations where the benefits we like to in this country are non-existent.

-

Details Of 2010 Federal Income Taxes

2024년 10월 05일

-

Item Reviews

2024년 10월 05일

-

How I Received Began With Sex Videos Free

2024년 10월 05일

-

10 Reasons Why Hiring Tax Service Is Vital!

2024년 10월 05일

-

Tampa Fl Private Driving Lessons.

2024년 10월 05일

-

Some Advice For Afc's & Pua's Struggling With Meeting Women

2024년 10월 05일

-

Avoiding The Heavy Vehicle Use Tax - Is It Really Really Worth The Trouble?

2024년 10월 05일

-

Who Owns Xnxxcom?

2024년 10월 05일

-

A Excellent Taxes - Part 1

2024년 10월 05일

-

Item Reviews

2024년 10월 05일

-

SEO, Content Marketing, & Link Building Approaches

2024년 10월 05일

-

Offshore Bank Accounts And The Latest Irs Hiring Spree

2024년 10월 05일

-

Tax Reduction Scheme 2 - Reducing Taxes On W-2 Earners Immediately

2024년 10월 05일

-

How Does Tax Relief Work?

2024년 10월 05일

-

Fort Worth, Texas

2024년 10월 05일

-

Can I Wipe Out Tax Debt In Going Bankrupt?

2024년 10월 05일

-

Quatre Façons Dont La Morosité De L'économie A Changé Mes Perspectives Sur Le Truffe Blanche

2024년 10월 05일

-

Annual Taxes - Humor In The Drudgery

2024년 10월 05일

-

Irs Taxes Owed - If Capone Can't Dodge It, Neither Are You Able To

2024년 10월 05일

-

Getting Regarding Tax Debts In Bankruptcy

2024년 10월 05일