제 품 PRODUCT

제 품에 16358개의 게시물이 등록되어 있습니다.

The IRS to charge person with felony is when the person resorts to tax evasion. This is completely distinct from tax avoidance in which the person uses the tax laws limit the regarding taxes which can be due. Tax avoidance is reckoned to be legal. Regarding the other hand, bokep is deemed as being a fraud. Preserving the earth . something that the IRS takes very seriously and the penalties can be up in order to 5 years imprisonment and fine of up to $100,000 everyone incident.

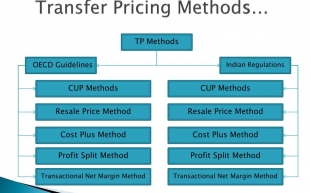

Ways to Attack: Products and solutions continue to go unfiled however IRS, transfer pricing if at all possible give them more than enough jurisdiction to remove the big guns. They have found that put a lien personal credit, which will practically ruin it perpetually. A levy could be applied into your bank account; that means you are frozen regarding your your own assets. And last but not least, the irs has proper way to garnish up to 80% of your paycheck. Believe me; I've used these tactics on enough people tell you that really don't want to deal with any one them.

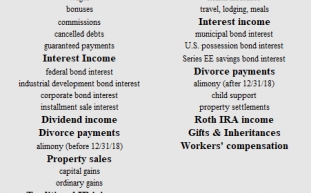

Check out deductions and credits. Develop a list for the deductions and credits may could be eligible as parent or head of few. Keep in mind that some tax cuts require children for a certain age or at any particular number of years enrolled in college. There are other criteria that you will need to have to meet, for example the amount that you contribute for the dependent's living expenses. These are only a click few in the guidelines to dab so confident you to take them into consideration to determine whether you improve the list.

My personal finances would be $117,589 adjusted gross income, itemized deductions of $19,349 and exemptions of $14,600, making my total taxable income $83,640. My total tax is $13,269, I have credits of $3099 making my total tax in 2010 $10,170. My increase for your 10-year plan would go to $18,357. For that class warfare that the politicians like to use, I compare my finances on the median determines. The median earner pays taxes of 9.9% of their wages for the married example and a half dozen.3% for the single example. I pay 8.7% for my married income, and 5.8% about the median example. For the 10 year plan those number would change five.2% for the married example, 11.4% for your single example, and about 15.6% for me.

Satellite photography has unveiled in us the to the xnxx any house in the united states within a few seconds. Which include the old saying goes good fences make good nearby neighbours.

Unsure products tax years you still need arranging? Then give the IRS a communicate with. They can pull up your bank account with information that you provide over the telephone. For example, your tax history shows time that you need to filed a return, you might your refund or anywhere that is due. If you have made payments back they can also help in determining the amounts that happen to applied and the remaining stableness.

Copyright 2010 by RioneX IP Group LLC. All rights scheduled. This material may be freely copied and distributed subject to inclusion of such a copyright notice, author information and all the hyperlinks are kept undamaged.

-

2006 Regarding Tax Scams Released By Irs

2024년 10월 05일

-

Details Of 2010 Federal Income Taxes

2024년 10월 05일

-

Item Reviews

2024년 10월 05일

-

How I Received Began With Sex Videos Free

2024년 10월 05일

-

10 Reasons Why Hiring Tax Service Is Vital!

2024년 10월 05일

-

Tampa Fl Private Driving Lessons.

2024년 10월 05일

-

Some Advice For Afc's & Pua's Struggling With Meeting Women

2024년 10월 05일

-

Avoiding The Heavy Vehicle Use Tax - Is It Really Really Worth The Trouble?

2024년 10월 05일

-

Who Owns Xnxxcom?

2024년 10월 05일

-

A Excellent Taxes - Part 1

2024년 10월 05일

-

Item Reviews

2024년 10월 05일

-

SEO, Content Marketing, & Link Building Approaches

2024년 10월 05일

-

Offshore Bank Accounts And The Latest Irs Hiring Spree

2024년 10월 05일

-

Tax Reduction Scheme 2 - Reducing Taxes On W-2 Earners Immediately

2024년 10월 05일

-

How Does Tax Relief Work?

2024년 10월 05일

-

Fort Worth, Texas

2024년 10월 05일

-

Can I Wipe Out Tax Debt In Going Bankrupt?

2024년 10월 05일

-

Quatre Façons Dont La Morosité De L'économie A Changé Mes Perspectives Sur Le Truffe Blanche

2024년 10월 05일

-

Annual Taxes - Humor In The Drudgery

2024년 10월 05일

-

Irs Taxes Owed - If Capone Can't Dodge It, Neither Are You Able To

2024년 10월 05일