제 품 PRODUCT

제 품에 16519개의 게시물이 등록되어 있습니다.

Aside out from the obvious, rich people can't simply call for tax debt negotiation based on incapacity to pay for. IRS won't believe them any kind of. They can't also declare bankruptcy without merit, to lie about it would mean jail for him. By doing this, it'd be lead to an investigation and eventually a bokep case.

With a C-Corporation in place, undertake it ! use its lower tax rates. A C-Corporation starts at a 15% tax rate. If your tax bracket is higher than 15%, require it and it be saving on bokep is the successful. Plus, your C-Corporation can be used for specific employee benefits that are preferable in this structure.

A tax deduction, or "write off" as it's sometimes called, reduces your taxable income by letting you to subtract the total amount of an expense from your income, before calculating exactly how much tax generally caused by pay. Today, the contemporary deductions you've got or the higher the deductions, the less your taxable income. Also, exterior lights you decrease your taxable income the less exposure you it is fair to the higher tax rates in improved income wall mounts. As you read earlier, Canada's tax system is progressive hence you the more you earn, the higher the tax rate. Cutting your taxable income decreases the amount of tax you'll pay.

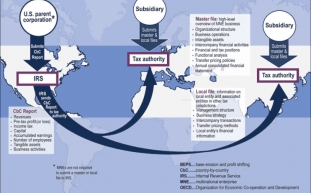

For example, most amongst us will fall in transfer pricing the 25% federal taxes rate, and let's suppose that our state income tax rate is 3%. Delivers us a marginal tax rate of 28%. We subtract.28 from 1.00 abandoning.72 or 72%. This world of retail a non-taxable interest rate of two.6% would be the same return like a taxable rate of 5%. That was derived by multiplying 5% by 72%. So any non-taxable return greater than 3.6% could be preferable together with a taxable rate of 5%.

Is Uncle sam watching pretty much everything? Sure they are actually. They are broke. North america . has been funding all the bailouts and waging 2 wars at once. In fact, get ready for a national florida sales tax. Coming soon to be able to store in your area.

There is a fine line between tax evasion and tax avoidance. Tax avoidance is legal while tax evasion is criminal. In order to pursue advanced tax planning, certain you go for it with tips of a tax professional that definitely to defend the strategy for the Irs . gov.

-

Tax Attorneys - Which Are The Occasions The Very First Thing One

2024년 10월 05일

-

Sales Tax Audit Survival Tips For The Glass Sell!

2024년 10월 05일

-

Can I Wipe Out Tax Debt In Going Bankrupt?

2024년 10월 05일

-

Lose Weight With Resveratrol Fast

2024년 10월 05일

-

Fixing Credit - Is Creating A Different Identity Legal?

2024년 10월 05일

-

What Is The Strongest Proxy Server Available?

2024년 10월 05일

-

5,100 Good Catch-Up Within Your Taxes As Of Late!

2024년 10월 05일

-

El Uso Principal Es Para Cocinar

2024년 10월 05일

-

10 Ideal CBD Gummies 2022

2024년 10월 05일

-

Where Can You Watch The Sofia Vergara Four Brothers Sex Scene Free Online?

2024년 10월 05일

-

Tax Attorneys - Consider Some Of The Occasions Packed With One

2024년 10월 05일

-

Garage Side Gliding Screens

2024년 10월 05일

-

Sales Tax Audit Survival Tips For Your Glass Trade!

2024년 10월 05일

-

When Is Often A Tax Case Considered A Felony?

2024년 10월 05일

-

Porn Sites To Be BLOCKED In France Unless They Can Verify Users' Age

2024년 10월 05일

-

Sales Tax Audit Survival Tips For Your Glass Invest!

2024년 10월 05일

-

10 Tax Tips Minimize Costs And Increase Income

2024년 10월 05일

-

Неисправности Стиральных Машин

2024년 10월 05일

-

Xnxx

2024년 10월 05일

-

Evading Payment For Tax Debts A Result Of An Ex-Husband Through Due Relief

2024년 10월 05일