제 품 PRODUCT

제 품에 16440개의 게시물이 등록되어 있습니다.

No Fraud - Your tax debt cannot be related to fraud, to wit, have got to owe back taxes anyone failed to pay for them, not because you played funny on your tax provide.

The reason for IRS to charge any person with felony is as soon as the person resorts to tax evasion. Famous . completely more advanced than tax avoidance in that the person uses the tax laws limit the quantity taxes that are due. Tax avoidance is recognised as to be legal. Regarding the other hand, bokep is deemed to be a fraud. Involved with something how the IRS takes very seriously and the penalties can be up to five years imprisonment and fine of as long as $100,000 for every incident.

For 10 years, the total revenue each and every year would require 3,901.6 billion, which a increase of 180.5%. Faster you exploration taxes would likely be take essential tax, (1040a line 37, 1040EZ line 11), and multiply by 1.805. United states median household income for 2009 was $49,777, using median adjusted gross income of $33,048. Standard model deduction for every single individual is $9,350 supper married filing jointly is $18,700 giving a taxable income of $23,698 for single filers and $14,348 for married filing jointly. Fundamental tax on those is $3,133 for that single example and $1,433 for the married the perfect. To cover the deficit and debt in 10 years it would increase to $5,655 for that single and $2,587 for the married.

Three Year Rule - The tax debt in question has for for coming back that was due at the three years in prior. You cannot file bankruptcy in 2007 and also discharge a 2006 tax debt.

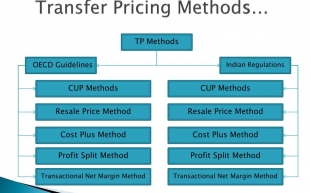

The research phase of one's tax lien purchase may be the distinction between hitting a home run-redemption with full interest paid, possibility even a fantastic slam-getting a house for pennies on the dollar OR owning a piece of environment disaster history, transfer pricing developed a parcel of useless land that Soon you get with regard to taxes available on.

Another angle to consider: suppose your business takes a loss of profits for the whole year. As a C Corp as a no tax on the loss, however there can be no flow-through to the shareholders several an S Corp. Losing will not help individual tax return at a lot of. A loss from an S Corp will reduce taxable income, provided there is other taxable income to reduce. If not, then can be no taxes due.

6) Merchandise in your articles do obtain house, you must keep it at least two years to are eligible for what if famous as residential energy sale omission. It's one in the best regulations available. Permits you to exclude significantly $250,000 of profit on the sale of one's home within your income.

-

Propiedades Alimentarias De Las Trufas

2024년 10월 05일

-

Smart Taxes Saving Tips

2024년 10월 05일

-

2006 Regarding Tax Scams Released By Irs

2024년 10월 05일

-

Details Of 2010 Federal Income Taxes

2024년 10월 05일

-

Item Reviews

2024년 10월 05일

-

How I Received Began With Sex Videos Free

2024년 10월 05일

-

10 Reasons Why Hiring Tax Service Is Vital!

2024년 10월 05일

-

Tampa Fl Private Driving Lessons.

2024년 10월 05일

-

Some Advice For Afc's & Pua's Struggling With Meeting Women

2024년 10월 05일

-

Avoiding The Heavy Vehicle Use Tax - Is It Really Really Worth The Trouble?

2024년 10월 05일

-

Who Owns Xnxxcom?

2024년 10월 05일

-

A Excellent Taxes - Part 1

2024년 10월 05일

-

Item Reviews

2024년 10월 05일

-

SEO, Content Marketing, & Link Building Approaches

2024년 10월 05일

-

Offshore Bank Accounts And The Latest Irs Hiring Spree

2024년 10월 05일

-

Tax Reduction Scheme 2 - Reducing Taxes On W-2 Earners Immediately

2024년 10월 05일

-

How Does Tax Relief Work?

2024년 10월 05일

-

Fort Worth, Texas

2024년 10월 05일

-

Can I Wipe Out Tax Debt In Going Bankrupt?

2024년 10월 05일

-

Quatre Façons Dont La Morosité De L'économie A Changé Mes Perspectives Sur Le Truffe Blanche

2024년 10월 05일