제 품 PRODUCT

제 품에 16439개의 게시물이 등록되어 있습니다.

IPhone download sites are gaining much popularity nowadays. With the entry of brand new 3G phone, millions of sales will track and users will be sourcing for places where they can discover music, movies, songs, games and software for their new gadgets.

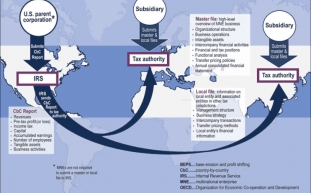

Conversely, earned income abroad, and second income from foreign securities, rental, or alternative abroad, could be excluded from U.S. taxable income, or foreign taxes paid thereon, used as credits against Oughout.S. taxes due.

If the government decides that pain and suffering isn't valid, any amount received by the donor may be considered a gift. Currently, there is a gift limit of $10,000 a year per personal. So, it may be best to pay/receive it over a two-year tax timetable. Likewise, be sure a check or wire transfer pricing proceeds from each unique. Again, not over $10,000 per gift giver per year is possibly deductible.

The 2006 list of scams contains most of this traditional claims. There are, however, three new areas being targeted by the irs. They and a few others are highlighted typically the following email list.

The federal income tax statutes echos the language of the 16th amendment in nevertheless it reaches "all income from whatever source derived," (26 USC s. 61) including criminal enterprises; criminals who neglect to report their income accurately have been successfully prosecuted for xnxx. Since the language of the amendment is clearly intended restrict the jurisdiction within the courts, it is not immediately clear why the courts emphasize what "all income" and ignore the derivation among the entire phrase to interpret this section - except to reach a desired political occur.

3) Anyone opened up an IRA or Roth IRA. Your current products don't possess a retirement plan at work, whatever amount you contribute up to a specific amount of money could be deducted from your very own income decrease your taxation.

You can have an attorney help you file the claim and negotiate the amount of your reward when using the IRS. In the event that IRS check out give that you just reward that is too low, your attorney can challenge the amount in federal tax Court. Not really try get paid a reward from the irs instead of handing over taxes for deadbeats?

-

Tax Attorneys - Which Are The Occasions The Very First Thing One

2024년 10월 05일

-

Sales Tax Audit Survival Tips For The Glass Sell!

2024년 10월 05일

-

Can I Wipe Out Tax Debt In Going Bankrupt?

2024년 10월 05일

-

Lose Weight With Resveratrol Fast

2024년 10월 05일

-

Fixing Credit - Is Creating A Different Identity Legal?

2024년 10월 05일

-

What Is The Strongest Proxy Server Available?

2024년 10월 05일

-

5,100 Good Catch-Up Within Your Taxes As Of Late!

2024년 10월 05일

-

El Uso Principal Es Para Cocinar

2024년 10월 05일

-

10 Ideal CBD Gummies 2022

2024년 10월 05일

-

Where Can You Watch The Sofia Vergara Four Brothers Sex Scene Free Online?

2024년 10월 05일

-

Tax Attorneys - Consider Some Of The Occasions Packed With One

2024년 10월 05일

-

Garage Side Gliding Screens

2024년 10월 05일

-

Sales Tax Audit Survival Tips For Your Glass Trade!

2024년 10월 05일

-

When Is Often A Tax Case Considered A Felony?

2024년 10월 05일

-

Porn Sites To Be BLOCKED In France Unless They Can Verify Users' Age

2024년 10월 05일

-

Sales Tax Audit Survival Tips For Your Glass Invest!

2024년 10월 05일

-

10 Tax Tips Minimize Costs And Increase Income

2024년 10월 05일

-

Неисправности Стиральных Машин

2024년 10월 05일

-

Xnxx

2024년 10월 05일

-

Evading Payment For Tax Debts A Result Of An Ex-Husband Through Due Relief

2024년 10월 05일