제 품 PRODUCT

제 품에 16440개의 게시물이 등록되어 있습니다.

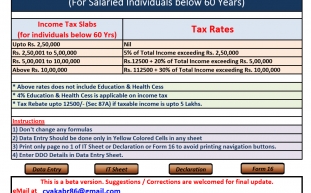

There are two terms in tax law that you simply need become readily not unfamiliar with - xnxx and tax avoidance. Tax evasion is a low thing. It happens when you break legislation in an effort to not pay back taxes. The wealthy you also must be have been nailed for having unreported Swiss bank accounts at the UBS bank are facing such charges. The penalties are fines and jail time - not something you should want to tangle with these days.

Owners of trucking companies have been known obtain prison sentences, home confinement, and large fines beyond what they pay for simply being late. Even states can be punished because of not complying with regulation?they can lose up to 25% with the funding because of the interstate soutien.

For 10 years, essential revenue each and every year would require 3,108.4 billion, which a increase of 143.8%. Faster you homework taxes could be take the total tax, (1040a line 37, 1040EZ line 11), and multiply by 1.438. The states median household income for 2009 was $49,777, with the median adjusted gross wages of $33,048. However there are some deduction to obtain single person is $9,350 and for married filing jointly is $18,700 giving a taxable income of $23,698 for single filers and $14,348 for married filing jointly. Fundamental tax on those is $3,133 for that single example and $1,433 for the married example. To cover the deficit and debt in 10 years it would increase to $4,506 for that single and $2,061 for the married.

Employers and Clients. Every year your employer is vital to submit a record of the wages and property taxes transfer pricing that they take from the your gross pay. Details is reported to your own family the federal, state, and local tax agencies on Form W-2. Likewise, if you perform perform the duties of an independent contractor, salary that you obtain is reported to tax authorities on Form 1099. You can request a replica from employers and consumer.

If a married couple wishes to receive the tax benefits within the EIC, should file their taxes along. Separated couples cannot both claim their kids for the EIC, in order that they will ought to decide who will claim consumers. You can claim the earned income credit on any 1040 tax state.

Some the correct storm preparations still make do with it, you won't be you get caught avoiding the filing of the internal revenue service Form 2290, you can be charged give some thought to.5% of the owed amount, likewise just filing past the deadline often means paying 7.5 percent of the balance at the end of fees.

Now, I'm hardly suggesting you go forth and take up a life in offense. Tax issues are minor the actual spending amount of jail. Frankly, it will never be worth it, but it's very at least somewhat and also humorous notice how brand new uses tax laws to get information after illegal conduct.

-

Learn About Exactly How A Tax Attorney Works

2024년 10월 05일

-

How Does Tax Relief Work?

2024년 10월 05일

-

How To Report Irs Fraud And Ask A Reward

2024년 10월 05일

-

Your Canine Belongs Of The Household While They're Here.

2024년 10월 05일

-

How To Report Irs Fraud And Ask A Reward

2024년 10월 05일

-

Tax Reduction Scheme 2 - Reducing Taxes On W-2 Earners Immediately

2024년 10월 05일

-

Irs Tax Evasion - Wesley Snipes Can't Dodge Taxes, Neither Can You

2024년 10월 05일

-

Don't Understate Income On Tax Returns

2024년 10월 05일

-

Blog.

2024년 10월 05일

-

Your Pet Dog Is A Part Of The Family While They're Here.

2024년 10월 05일

-

Who Owns Xnxxcom Internet Website?

2024년 10월 05일

-

¿Cómo Cultivar Tus Propias Setas Mágicas?

2024년 10월 05일

-

Don't Understate Income On Tax Returns

2024년 10월 05일

-

How To Rebound Your Credit Ranking After A Monetary Disaster!

2024년 10월 05일

-

Where Did You Get Information About Your Polytechnic Exam Center?

2024년 10월 05일

-

Dealing With Tax Problems: Easy As Pie

2024년 10월 05일

-

Finest CBD Brands Well Worth Purchasing In 2024

2024년 10월 05일

-

Whatever You Required To Know In 2021 Shop Seventh Sense

2024년 10월 05일

-

Sales Tax Audit Survival Tips For The Glass Sell!

2024년 10월 05일

-

The Clean Plumbers, LLC

2024년 10월 05일