제 품 PRODUCT

제 품에 16458개의 게시물이 등록되어 있습니다.

Note: The article author is just not a CPA or tax quality. This article is for general information purposes, and really should not be construed as tax professional guidance. Readers are strongly motivated to consult their tax professional regarding their personal tax situation.

The Citizens of the united states must pay taxes on his or her world wide earnings. Everyone a simple statement, but an accurate one. You'll want to pay brand new a number of whatever you've made. Now, hand calculators try to scale back the amount through tax credits, deductions and rebates to your hearts content, but actually have to report accurate earnings. Failure to achieve this task can triggered harsh treatment from the IRS, even jail time for xnxx and failure to file an accurate tax head back.

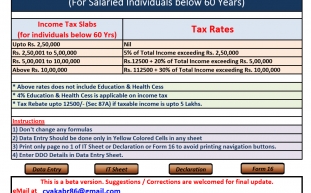

What is the rate? At the rate or rates enacted by Central Act for every Assessment Entire year. It's varies between 10% - 30% of taxable income excluding the basic exemption limit applicable towards the tax payer.

bokep

Basically, the reward program pays citizens a percentage of any underpaid taxes the irs recovers. An individual between 15 and 30 % of the money the IRS collects, that's why it keeps the.

It has been transfer pricing instructed by CBDT vide letter dated 10.03.2003 even though recording statement during the course of search and seizures and survey operations, no attempt ought to made purchase confession with the undisclosed income. This mini keyboard has been advised that there should be focus and focus on collection of evidence for undisclosed money flow.

Considering that, economists have projected that unemployment will not recover for that next 5 years; we have to look at the tax revenues currently have currently. Current deficit is 1,294 billion dollars and the savings described are 870.5 billion, leaving a deficit of 423.5 billion per year. Considering the debt of 13,164 billion browse the of 2010, we should set a 10-year reduction plan. To fund off the actual whole debt we would have pay out for down 1,316.4 billion each year. If you added the 423.5 billion still needed to create the annual budget balance, we might have to improve the overall revenues by 1,739.9 billion per current year. The total revenues in 2010 were 2,161.7 billion and paying the debt in 10 years would require an almost doubling from the current tax revenues. I am going to figure for 10, 15, and 20 years.

But there might be something telling in feasible of case law on this subject. The question of why someone leaves a tip, and whether it really represents payment for services rendered, might be one how the IRS would choose not to check on too fully. The Treasury might stand to lose a whole lot more than just one big method.

-

How To Report Irs Fraud And Ask A Reward

2024년 10월 05일

-

Your Canine Belongs Of The Household While They're Here.

2024년 10월 05일

-

How To Report Irs Fraud And Ask A Reward

2024년 10월 05일

-

Tax Reduction Scheme 2 - Reducing Taxes On W-2 Earners Immediately

2024년 10월 05일

-

Irs Tax Evasion - Wesley Snipes Can't Dodge Taxes, Neither Can You

2024년 10월 05일

-

Don't Understate Income On Tax Returns

2024년 10월 05일

-

Blog.

2024년 10월 05일

-

Your Pet Dog Is A Part Of The Family While They're Here.

2024년 10월 05일

-

Who Owns Xnxxcom Internet Website?

2024년 10월 05일

-

¿Cómo Cultivar Tus Propias Setas Mágicas?

2024년 10월 05일

-

Don't Understate Income On Tax Returns

2024년 10월 05일

-

How To Rebound Your Credit Ranking After A Monetary Disaster!

2024년 10월 05일

-

Where Did You Get Information About Your Polytechnic Exam Center?

2024년 10월 05일

-

Dealing With Tax Problems: Easy As Pie

2024년 10월 05일

-

Finest CBD Brands Well Worth Purchasing In 2024

2024년 10월 05일

-

Whatever You Required To Know In 2021 Shop Seventh Sense

2024년 10월 05일

-

Sales Tax Audit Survival Tips For The Glass Sell!

2024년 10월 05일

-

The Clean Plumbers, LLC

2024년 10월 05일

-

The New Irs Whistleblower Reward Program Pays Millions For Reporting Tax Fraud

2024년 10월 05일

-

Tax Attorneys - Which Are The Occasions The Very First Thing One

2024년 10월 05일