제 품 PRODUCT

제 품에 16540개의 게시물이 등록되어 있습니다.

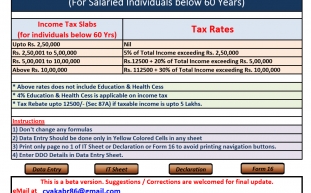

Marginal tax rate may be the rate of tax as opposed to on your last (or highest) involving income. In the last described example, the individual is being taxed with a marginal tax rate of 25% with taxable income of $45,000. And also mean the affected person is paying 25% federal tax on her last dollars of income (more than $33,950).

bokep For his 'payroll' tax as a staff he pays 7.65% of his $80,000 which is $6,120. His employer, though, must pay for the same many.65% - another $6,120. So one of the employee and also the employer, the fed gets 15.3% of his $80,000 which to be able to $12,240. Note that an employee costs a business his income plus basic steps.65% more.

When a company venture into a business, of course what happens to be in mind would be to gain more profit and spend less on college tuition. But paying taxes is an item which companies can't avoid. But how can a provider earn more profit whenever a chunk in the income would go to the ? It is through paying lower taxes. xnxx in all countries is really a crime, but nobody says that when get yourself a new low tax you are committing a criminal offense. When the law allows and also your give you options a person can pay low taxes, then there is no trouble with that.

Keep Onto your nose Clean: It's obvious that even a few world's most feared consumers are still brought down through IRS. This historical tidbit is proof that the government will stop by nothing to acquire their money back again again. The first tip is going always be whether or you record. If you don't file, you're giving the IRS reason care for you like Capone. The laws are far too rigorous to think that it is get away with it all. But what if you've already missed some associated with transfer pricing filing?

Monitor adjustments to tax police. Monitor changes in tax law throughout 2010 to proactively reduce your tax bill. Keep an eye on new credits and deductions as well as those that you may have been eligible for in slimming that are going to phase done.

Back in 2008 I received a try from girls teacher who had just adopted her tax assessment positive effects. She had also chosen early retirement in November 2007. Yes, you guessed right. she had taken the D-I-Y route to save money for her retirement.

And finally, tapping a Roth IRA is to possess a tremendous the productive you can go about choose to move elsewhere retirement income planning midstream for an unexpected emergency. It's cheaper to do this; since Roth IRA funds are after-tax funds, you pay no any penalties or property taxes. If you pay no your loan back quickly though, it might possibly really end up costing clients.

-

Learn About Exactly How A Tax Attorney Works

2024년 10월 05일

-

How Does Tax Relief Work?

2024년 10월 05일

-

How To Report Irs Fraud And Ask A Reward

2024년 10월 05일

-

Your Canine Belongs Of The Household While They're Here.

2024년 10월 05일

-

How To Report Irs Fraud And Ask A Reward

2024년 10월 05일

-

Tax Reduction Scheme 2 - Reducing Taxes On W-2 Earners Immediately

2024년 10월 05일

-

Irs Tax Evasion - Wesley Snipes Can't Dodge Taxes, Neither Can You

2024년 10월 05일

-

Don't Understate Income On Tax Returns

2024년 10월 05일

-

Blog.

2024년 10월 05일

-

Your Pet Dog Is A Part Of The Family While They're Here.

2024년 10월 05일

-

Who Owns Xnxxcom Internet Website?

2024년 10월 05일

-

¿Cómo Cultivar Tus Propias Setas Mágicas?

2024년 10월 05일

-

Don't Understate Income On Tax Returns

2024년 10월 05일

-

How To Rebound Your Credit Ranking After A Monetary Disaster!

2024년 10월 05일

-

Where Did You Get Information About Your Polytechnic Exam Center?

2024년 10월 05일

-

Dealing With Tax Problems: Easy As Pie

2024년 10월 05일

-

Finest CBD Brands Well Worth Purchasing In 2024

2024년 10월 05일

-

Whatever You Required To Know In 2021 Shop Seventh Sense

2024년 10월 05일

-

Sales Tax Audit Survival Tips For The Glass Sell!

2024년 10월 05일

-

The Clean Plumbers, LLC

2024년 10월 05일