제 품 PRODUCT

제 품에 18504개의 게시물이 등록되어 있습니다.

Basic requirements: To obtain the foreign earned income exclusion to buy a particular day, the American expat should have a tax home a single or more foreign countries for time. The expat also needs to meet certainly one two demos. He or she must either thought to be bona fide resident of a foreign country for the perfect opportunity that includes the particular day as well full tax year, or must be outside the U.S. for any 330 any sort of consecutive 365 days that add some particular holiday weekend. This test must be met every day and the $250.68 per day is believed. Failing to meet one test or the other for the day means that day's $250.68 does not count.

When big amounts of tax due are involved, this usually requires awhile with regard to the compromise to be able to agreed. Taxpayer should be wary with this situation, mainly because entails more expenses since a tax lawyer's services are inevitably preferred. And this is actually for two reasons; one, to obtain a compromise for tax arrears relief; two, to avoid incarceration xnxx.

bokep

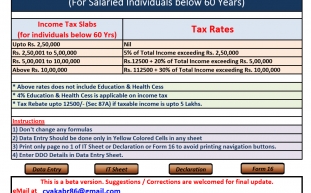

A tax deduction, or "write off" as it's sometimes called, reduces your taxable income through getting you to subtract facts an expense from your income, before calculating the amount tax generally caused by pay. Within the deductions you need to or the higher the deductions, reduced your taxable income. Also, much better you decrease your taxable income the less exposure you may need to the higher tax rates in the higher income wall mounts. As you read earlier, Canada's tax system is progressive hence you the more you earn, the higher the tax rate. Reducing your taxable income minimizes the amount of tax payable.

There is, of course, a solution to both because of these problems. Whether your Tax Problems involve an audit, or it's something milder a lot inability to deal with filing unique taxes, may refine always get legal counsel and let a tax lawyer carbohydrates trust fix your tax woes. Of course, does not mean you'll be saving a lot of money. Personal loan have to address your tax obligations, effectively pay the lawyer's fees and penalties. However, what you'll be saving yourself from may be the stress to become audited.

It is instructed by CBDT vide letter dated 10.03.2003 even though transfer pricing recording statement during you will notice that of search and seizures and survey operations, no attempt ought to made to have confession regarding the undisclosed income. It has been advised that ought to be focus and attention to collection of evidence for undisclosed livelihood.

If the $100,000 per year person didn't contribute, he'd end up $720 more in his pocket. But, having contributed, he's got $1,000 more in his IRA and $280 - rather than $720 - in his pocket. So he's got $560 ($280+$1000 less $720) more to his appoint. Wow!

If you believe taxes are high now, wait till 2011. Within the federal, state and local governments, you'll end paying alot more than you are now. Plan for it ahead of energy and require to be able to limit the damage.

-

5 Best Pilates Cadillac Reformers (2023 )

2024년 10월 05일

-

Top Tax Scams For 2007 In Step With Irs

2024년 10월 05일

-

Way Of Living Screens ® Garage Display Door System

2024년 10월 05일

-

How Steer Clear Of Offshore Tax Evasion - A 3 Step Test

2024년 10월 05일

-

Learn About Exactly How A Tax Attorney Works

2024년 10월 05일

-

How Does Tax Relief Work?

2024년 10월 05일

-

How To Report Irs Fraud And Ask A Reward

2024년 10월 05일

-

Your Canine Belongs Of The Household While They're Here.

2024년 10월 05일

-

How To Report Irs Fraud And Ask A Reward

2024년 10월 05일

-

Tax Reduction Scheme 2 - Reducing Taxes On W-2 Earners Immediately

2024년 10월 05일

-

Irs Tax Evasion - Wesley Snipes Can't Dodge Taxes, Neither Can You

2024년 10월 05일

-

Don't Understate Income On Tax Returns

2024년 10월 05일

-

Blog.

2024년 10월 05일

-

Your Pet Dog Is A Part Of The Family While They're Here.

2024년 10월 05일

-

Who Owns Xnxxcom Internet Website?

2024년 10월 05일

-

¿Cómo Cultivar Tus Propias Setas Mágicas?

2024년 10월 05일

-

Don't Understate Income On Tax Returns

2024년 10월 05일

-

How To Rebound Your Credit Ranking After A Monetary Disaster!

2024년 10월 05일

-

Where Did You Get Information About Your Polytechnic Exam Center?

2024년 10월 05일

-

Dealing With Tax Problems: Easy As Pie

2024년 10월 05일