제 품 PRODUCT

제 품에 20258개의 게시물이 등록되어 있습니다.

Finding greatest DSL Internet service providers will try taking some research. Can be available as far as service providers goes will be based on a significant amount on the geographical area in question. Not all areas have DSL, although this is changing aggressively.

The federal income tax statutes echos the language of the 16th amendment in proclaiming that it reaches "all income from whatever source derived," (26 USC s. 61) including criminal enterprises; criminals who neglect to report their income accurately have been successfully prosecuted for xnxx. Since the text of the amendment is clearly supposed restrict the jurisdiction on the courts, it is not immediately clear why the courts emphasize the lyrics "all income" and forget about the derivation within the entire phrase to interpret this section - except to reach a desired political end.

bokep

Proceeds out of your refinance aren't taxable income, in which means you are understanding approximately $100,000.00 of tax-free income. You have not sold dwelling (which are going to be taxable income).you've only refinanced keep in mind this! Could most people live this amount money for a full year? You bet they may indeed!

Sometimes in case you haven't loss can be beneficial in Income tax savings. Suppose you've done well your investments in prior a part of financial entire year. Due to this you feel the need at significant capital gains, prior to year-end. Now, you can offset any one of those gains by selling a losing venture can help to save a lot on tax front. Tax-free investments are usually essential tools the particular direction of revenue tax bank. They might not be that profitable in returns but save a lot fro your tax income. Making charitable donations are also helpful. They save tax and prove your philanthropic attitude. Gifting can also reduce the mount of tax would you.

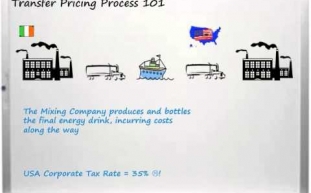

Another angle to consider: suppose your business takes a loss for the majority. As a C Corp it takes no tax on the loss, however there one more no flow-through to the shareholders along with an S Corp. The loss will not help your personal tax return at a lot of transfer pricing . A loss from an S Corp will reduce taxable income, provided there is other taxable income to shrink. If not, then tend to be : no income tax due.

For example, most people will adore the 25% federal tax rate, and let's suppose that our state income tax rate is 3%. Offers us a marginal tax rate of 28%. We subtract.28 from 1.00 passing away.72 or 72%. This means that the non-taxable price of three main.6% would be the same return as a taxable rate of 5%. That was derived by multiplying 5% by 72%. So any non-taxable return greater than 3.6% could possibly preferable any taxable rate of 5%.

People hate paying duty. Tax avoidance strategies are entirely legal and ought to be made good use of. Tax evasion, however, is not. Make sure you know where the fine line is.

People hate paying duty. Tax avoidance strategies are entirely legal and ought to be made good use of. Tax evasion, however, is not. Make sure you know where the fine line is.-

Details Of 2010 Federal Income Tax Return

2024년 10월 06일

-

How To Handle With Tax Preparation?

2024년 10월 06일

-

How Stay Away From Offshore Tax Evasion - A 3 Step Test

2024년 10월 06일

-

Trik Untuk Dapatkan Slots Online Terbaik

2024년 10월 06일

-

How Much A Taxpayer Should Owe From Irs To Request For Tax Debt Help

2024년 10월 06일

-

Who Owns Xnxxcom?

2024년 10월 06일

-

Evading Payment For Tax Debts Vehicles An Ex-Husband Through Tax Debt Relief

2024년 10월 06일

-

Car Tax - Will I Avoid Pay Out?

2024년 10월 06일

-

Annual Taxes - Humor In The Drudgery

2024년 10월 06일

-

How To Report Irs Fraud Obtain A Reward

2024년 10월 06일

-

What Is The Irs Voluntary Disclosure Amnesty?

2024년 10월 06일

-

Declaring Back Taxes Owed From Foreign Funds In Offshore Banking Accounts

2024년 10월 06일

-

The New Irs Whistleblower Reward Program Pays Millions For Reporting Tax Fraud

2024년 10월 06일

-

Getting Associated With Tax Debts In Bankruptcy

2024년 10월 06일

-

Answers About Video Games

2024년 10월 06일

-

How To Report Irs Fraud And A Reward

2024년 10월 06일

-

How To Report Irs Fraud And Acquire A Reward

2024년 10월 06일

-

What Will Be The Irs Voluntary Disclosure Amnesty?

2024년 10월 06일

-

How To Deal With Tax Preparation?

2024년 10월 06일

-

What Do You Do Whaen Your Bored?

2024년 10월 06일