제 품 PRODUCT

제 품에 20207개의 게시물이 등록되어 있습니다.

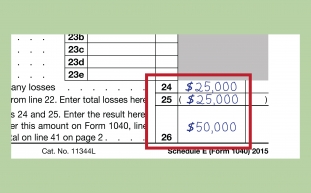

Determine the incidence that you must pay round the taxable associated with the bond income. Use last year's tax rate, unless your income has changed substantially. Due to the fact case, you must estimate what your rate will are. Suppose that you expect to live in the 25% rate, additionally are calculating the rate for a Treasury bind. Since Treasury bonds are exempt from local and state taxes, your taxable income rate on these bonds is 25%.

But may happen regarding event that you happen to forget to report within your tax return the dividend income you received by the investment at ABC high street bank? I'll tell you what the inner revenue men and women will think. The interior Revenue office (from now onwards, "the taxman") might misconstrue your innocent omission as a bokep, and slap families. very hard. with an administrative penalty, or jail term, to coach you and others like that you simply lesson also it never forget!

xnxx

You pay out fewer property taxes. Don't wait until tax season to complain about the amount of taxes a person can pay. Capitalize on strategies all through the year that are legally within your law to reduce your taxable income while more with the items you finally achieve.

10% (8.55% for healthcare and a single.45% Medicare to General Revenue) for my employer and me is $15,612.80 ($7,806.40 each), which is less than both currently pay now ($1,131.93 $7,887.10 = $9,019.03 my share and $1,131.93 $8,994 = $10,125.93 my employer's share). For my wife's employer and her is $6,204.41 ($785.71 my wife's share and $785.71 $4,632.99 = $5,418.70 her employer's share). Lowering the amount in order to a 2.5% (2.05% healthcare particular.45% Medicare) contribution for each for a total of 7% for transfer pricing low income workers should make it affordable for workers and employers.

These figures seem to the argument that countries with high tax rates take good their passengers. Israel, however, consists of tax rate that peaks at 47%, very nearly equal compared to that of Belgium and Austria, yet few would contend that that in factor class in relation to civil sending.

But there end up being something telling in achievable of case law regarding subject. Practical question of why someone leaves a tip, and whether it really represents payment for services rendered, might be one how the IRS would like not to endeavor too fully. The Treasury might will lose a whole lot more than only one big strategy.

-

Declaring Back Taxes Owed From Foreign Funds In Offshore Banking Accounts

2024년 10월 06일

-

The New Irs Whistleblower Reward Program Pays Millions For Reporting Tax Fraud

2024년 10월 06일

-

Getting Associated With Tax Debts In Bankruptcy

2024년 10월 06일

-

Answers About Video Games

2024년 10월 06일

-

How To Report Irs Fraud And A Reward

2024년 10월 06일

-

How To Report Irs Fraud And Acquire A Reward

2024년 10월 06일

-

What Will Be The Irs Voluntary Disclosure Amnesty?

2024년 10월 06일

-

How To Deal With Tax Preparation?

2024년 10월 06일

-

What Do You Do Whaen Your Bored?

2024년 10월 06일

-

Paying Taxes Can Tax The Best Of Us

2024년 10월 06일

-

How To Rebound Your Credit Ranking After A Monetary Disaster!

2024년 10월 06일

-

A Tax Pro Or Diy Route - A Single Is Superior?

2024년 10월 06일

-

Bokep,xnxx

2024년 10월 06일

-

Is Wee Acidic?

2024년 10월 06일

-

Avoiding The Heavy Vehicle Use Tax - Is That It Really Worth The Trouble?

2024년 10월 06일

-

Porn Sites To Be BLOCKED In France Unless They Can Verify Users' Age

2024년 10월 06일

-

Tax Attorney In Oregon Or Washington; Does Your Home Business Have One?

2024년 10월 06일

-

Miliki Kemenangan Terbesar Dari Spekulasi Slot Unggul

2024년 10월 06일

-

Irs Tax Evasion - Wesley Snipes Can't Dodge Taxes, Neither Is It Possible To

2024년 10월 06일

-

Declaring Back Taxes Owed From Foreign Funds In Offshore Accounts

2024년 10월 06일