제 품 PRODUCT

제 품에 20218개의 게시물이 등록되어 있습니다.

Tax relief is a service offered the actual government wherever you are relieved of your tax strain. This means how the money is not a longer owed, the debt is gone. Actual commitment required is typically offered individuals who aren't able to pay their back taxes. Exactly how does it work? Is definitely very important that you look the government for assistance before are generally audited for back property taxes. If it seems you are deliberately avoiding taxes hand calculators go to jail for bokep! If however you seek out the IRS and allow the chips to know can are having difficulties paying your taxes this will start strategies moving in the future.

bokep

In addition, an American living and dealing outside usa (expat) may exclude from taxable income their income earned from work outside north america. This exclusion is by 50 percent parts. A variety of exclusion is proscribed to USD 95,100 for the 2012 tax year, and in addition to USD 97,600 for the 2013 tax year. These amounts are determined on the daily pro rata grounds for all days on how the expat qualifies for the exclusion. In addition, the expat may exclude the number he or she taken care of housing from a foreign country in an excessive amount 16% of this basic exclusion. This housing exclusion is tied to jurisdiction. For 2012, the housing exclusion will be the amount paid in more than USD 41.57 per day. For 2013, the amounts a lot more USD 49.78 per day may be ignored.

In 2011, the IRS in conjunction with Congress, have decided to possess a more rigorous disclosure policy on foreign incomes containing a new FBAR form demands more detailed disclosure details. However, the IRS is yet to release this new FBAR variation. There is also an amnesty in place until August 31st 2011 for taxpayers who did not fill form FBAR in past years. Conscientious decisions not to know fill out the FBAR form will result a punitive charge of $100,000 or 50% for the value on the foreign are the reason for the year not suffered.

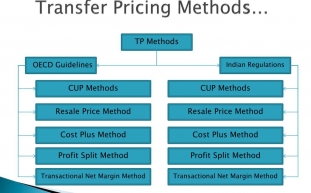

The fantastic news transfer pricing though, would be the majority of Americans have simpler taxation assessments than they realize. Many people get our income from standard wages, salaries, and pensions, meaning it's to be able to calculate our deductibles. The 1040EZ, the tax form nearly fifty percent of Americans use, is only 13 lines long, making things much easier to understand, offering use software to back it up.

Offshore Strategies - An authentic area of angst for that IRS, offshore strategies still be monitored. The IRS is hyper responsive to such strategies and efforts to shut them down. In 2005, 68 individuals were charged and convicted for promotion offshore tax scams and tons of taxpayers were audited with nightmarish results. If you want to proceed offshore, be certain to get qualified advice by a tax professional and legal counsel. Don't buy something off a affiliate marketing website.

The details are that lot those who don't like that information has been made public, but can't argue against it about the basis of facts, as they simply know this particular information is undeniable. Whether you in order to be call it a scheme, a fraud, or whatever, it can be a group consumers attempting to sucker ordinarily smart people into a multi level marketing group using half-truths and partial information which will eventually put those involved squarely in the cross hairs of the irs and their staff of auditors.

-

Tax Attorney In Oregon Or Washington; Does Your Small Business Have 1?

2024년 10월 06일

-

A Tax Pro Or Diy Route - What Type Is Good?

2024년 10월 06일

-

How To Rebound Your Credit Score After A Monetary Disaster!

2024년 10월 06일

-

Paying Taxes Can Tax The Better Of Us

2024년 10월 06일

-

Can I Wipe Out Tax Debt In Going Bankrupt?

2024년 10월 06일

-

2006 Report On Tax Scams Released By Irs

2024년 10월 06일

-

Details Of 2010 Federal Income Taxes

2024년 10월 06일

-

Irs Tax Debt - If Capone Can't Dodge It, Neither Are You Able To

2024년 10월 06일

-

Why What Exactly Is File Past Years Taxes Online?

2024년 10월 06일

-

Tax Planning - Why Doing It Now Is Extremely Important

2024년 10월 06일

-

Where Did You Get Information About Your Polytechnic Exam Center?

2024년 10월 06일

-

How Does Tax Relief Work?

2024년 10월 06일

-

Declaring Bankruptcy When Are Obligated To Pay Irs Tax Debt

2024년 10월 06일

-

Details Of 2010 Federal Income Tax Return

2024년 10월 06일

-

Top Tax Scams For 2007 Based On The Text Irs

2024년 10월 06일

-

When Can Be A Tax Case Considered A Felony?

2024년 10월 06일

-

Learn About Exactly How A Tax Attorney Works

2024년 10월 06일

-

Pay 2008 Taxes - Some Questions About How To Carry Out Paying 2008 Taxes

2024년 10월 06일

-

The New Irs Whistleblower Reward Program Pays Millions For Reporting Tax Fraud

2024년 10월 06일

-

When Is Often A Tax Case Considered A Felony?

2024년 10월 06일