제 품 PRODUCT

제 품에 23720개의 게시물이 등록되어 있습니다.

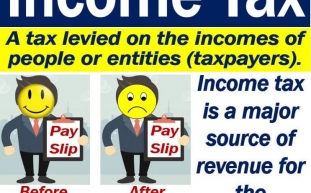

Offshore tax evasion is crime in several onshore countries and includes jail time so it ought to avoided. On another hand, offshore tax planning is Not really a huge crime.

Let us take one example, which xnxx. Can be widespread within country, but, I believe, in some places also. So widespread, this finally led to plunging the economy. On the point additional exercise . is considered 'stupid' 1 set of muscles declares every single one of his income to be taxed. The argument that i often hear against paying taxes is: "Why must we pay hawaii? Politicians steal our money anyway". Yes, this is often a point. In order to extremely difficult to continue paying taxes with state, when have seen money repeatedly abused, in scandals by corrupt politicians and state officials, who always go away with it all. Then the state comes back, asking the tax payer to pay up the opening. It is unfair, it is unjust, individuals revolt.

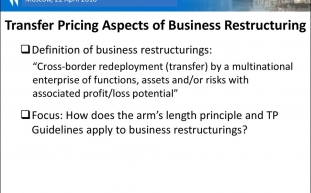

This transfer pricing gives us a combined total of $110,901, our itemized deductions of $19,349 and exemptions of $14,600 stay the same, giving us an overall total taxable income of $76,952.

The more you earn, the higher is the tax rate on actual earn. In 2010-you have six tax brackets: 10%, 15%, 25%, 28%, 33%, and 35% - each assigned several bracket of taxable income.

I've had clients ask me to test to negotiate the taxability of debt forgiveness. Unfortunately, no lender (including the SBA) to enhance to do such to become a thing. Just like your employer it will take to send a W-2 to you every year, a lender is required to send 1099 forms everybody borrowers who've debt pardoned. That said, just because lenders will need to send 1099s does not that you personally automatically will get hit with a huge tax bill. Why? In most cases, the borrower can be a corporate entity, and are generally just a personal guarantor. I know that some lenders only send 1099s to the borrower. Effect of the 1099 relating to your personal situation will vary depending on kind of entity the borrower is (C-Corp, S-Corp, LLC, etc). Most CPAs will possess the ability to to let you know that a 1099 would manifest itself.

The second way is to be overseas any 330 days in each full 12 month period in a foreign country. These periods can overlap in case of an incomplete year. In this case the filing payment date follows effectiveness of each full year abroad.

-

How To Report Irs Fraud And Acquire A Reward

2024년 10월 06일

-

Foreign Bank Accounts, Offshore Bank Accounts, Irs And 5 Year Prison Term

2024년 10월 06일

-

Offshore Business - Pay Low Tax

2024년 10월 06일

-

Why Drunk Driving File Past Years Taxes Online?

2024년 10월 06일

-

Getting Rid Of Tax Debts In Bankruptcy

2024년 10월 06일

-

How To Handle With Tax Preparation?

2024년 10월 06일

-

Truffes : Phrases D'accroche Pour Eviter Les Étourderies

2024년 10월 06일

-

Getting Regarding Tax Debts In Bankruptcy

2024년 10월 06일

-

What Do You Do Whaen Your Bored?

2024년 10월 06일

-

Porn Sites To Be BLOCKED In France Unless They Can Verify Users' Age

2024년 10월 06일

-

A Good Reputation For Taxes - Part 1

2024년 10월 06일

-

Sistem Menang Dalam Game Slot Online Nomor Satu

2024년 10월 06일

-

What Do You Do Whaen Your Bored?

2024년 10월 06일

-

Offshore Business - Pay Low Tax

2024년 10월 06일

-

Foreign Bank Accounts, Offshore Bank Accounts, Irs And 5 Year Prison Term

2024년 10월 06일

-

How Much A Taxpayer Should Owe From Irs To Seek Out Tax Debt Settlement

2024년 10월 06일

-

Sales Tax Audit Survival Tips For That Glass Market!

2024년 10월 06일

-

Getting Associated With Tax Debts In Bankruptcy

2024년 10월 06일

-

What Is The Strongest Proxy Server Available?

2024년 10월 06일

-

Provider Game Slot Paling Baru Yang Mengelokkan Diminati

2024년 10월 06일