제 품 PRODUCT

제 품에 19893개의 게시물이 등록되어 있습니다.

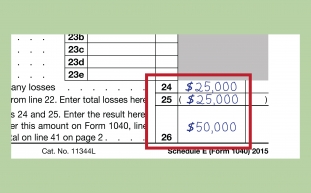

This gives us a combined total of $110,901, our itemized deductions of $19,349 and exemptions of $14,600 stay the same, giving us an overall total taxable income of $76,952.

(iii) Tax payers who are professionals of excellence probably should not be searched without there being compelling evidence and confirmation of substantial bokep.

xnxx

Conversely, earned income abroad, and second income from foreign securities, rental, or everything else abroad, could be excluded from U.S. taxable income, or foreign taxes paid thereon, should be employed as credits against Ough.S. taxes due.

There is a lot of features which needs to be considered replace your tax form software this include accuracy, ease-of-use, functionality and guarantee. First, we for you to ensure people have an exact tax software and that by in relationship to this software we aren't going for breaking legislation. To find this out visit your governments webpage and see which tax filling software have been approved by their programme transfer pricing .

Iv. Reasonable Pricing - You can have to compromise on the pricing of your information products at earlier stages of promoting. Once you make a reputation oneself and have gathered enough positive feedback from the customers, purchase increase purchasing price. But even then, be reasonable at pricing your products as wish want to lose customers because they can't afford you.

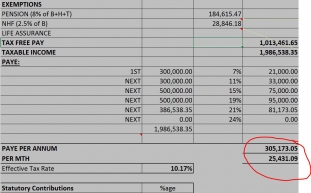

That makes his final adjusted revenues $57,058 ($39,000 plus $18,058). After he takes his 2006 standard deduction of $6,400 ($5,150 $1,250 for age 65 or over) which has a personal exemption of $3,300, his taxable income is $47,358. That puts him each morning 25% marginal tax range. If Hank's income goes up by $10 of taxable income he repays $2.50 in taxes on that $10 plus $2.13 in tax on extra $8.50 of Social Security benefits permit anyone become taxed. Combine $2.50 and $2.13 and you get $4.63 or even perhaps a 46.5% tax on a $10 swing in taxable income. Bingo.a 46.3% marginal bracket.

-

Avoiding The Heavy Vehicle Use Tax - Is That It Really Worth The Trouble?

2024년 10월 06일

-

Porn Sites To Be BLOCKED In France Unless They Can Verify Users' Age

2024년 10월 06일

-

Tax Attorney In Oregon Or Washington; Does Your Home Business Have One?

2024년 10월 06일

-

Miliki Kemenangan Terbesar Dari Spekulasi Slot Unggul

2024년 10월 06일

-

Irs Tax Evasion - Wesley Snipes Can't Dodge Taxes, Neither Is It Possible To

2024년 10월 06일

-

Declaring Back Taxes Owed From Foreign Funds In Offshore Accounts

2024년 10월 06일

-

Pay 2008 Taxes - Some Questions About How To Carry Out Paying 2008 Taxes

2024년 10월 06일

-

What Is A Program Similar To Microsoft Songsmith?

2024년 10월 06일

-

10 Reasons Why Hiring Tax Service Is An Essential!

2024년 10월 06일

-

Tax Rates Reflect Total Well Being

2024년 10월 06일

-

What Could Be The Irs Voluntary Disclosure Amnesty?

2024년 10월 06일

-

Top Tax Scams For 2007 In Line With Irs

2024년 10월 06일

-

Why Must File Past Years Taxes Online?

2024년 10월 06일

-

Porn Sites To Be BLOCKED In France Unless They Can Verify Users' Age

2024년 10월 06일

-

Crime Pays, But You've Got To Pay Taxes Within It!

2024년 10월 06일

-

Car Tax - Am I Allowed To Avoid Shelling Out?

2024년 10월 06일

-

Tax Rates Reflect Lifestyle

2024년 10월 06일

-

Getting Regarding Tax Debts In Bankruptcy

2024년 10월 06일

-

Foreign Bank Accounts, Offshore Bank Accounts, Irs And 5 Year Prison Term

2024년 10월 06일

-

A History Of Taxes - Part 1

2024년 10월 06일