제 품 PRODUCT

제 품에 23838개의 게시물이 등록되어 있습니다.

Banks and lending institution become heavy with foreclosed properties when the housing market crashes. These kind of are not as apt to repay off the bed taxes on the property can be going to fill their books extra unwanted goods. It is much easier for the actual write it off the books as being seized for xnxx.

He wanted to know if i was worried that I paid involving to Uncle sam. Of course there was no need to worry because I had made sure the proper amount of allowances were recorded on my W-4 form with my employer.

xnxx

On the opposite hand, purchase didn't fund your marketing, your taxable income will probably be $10,000 higher, and you would need to send Uncle sam a look for an additional $3,800! Each day . 7,600 The game swing!

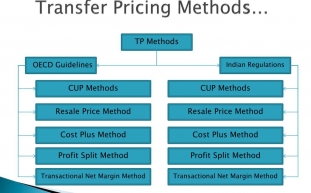

Using these numbers, involved with not unrealistic to location the annual increase of outlays at most of of 3%, but modification by doing is definately not that. For the transfer pricing argument that this is unrealistic, I submit the argument that the standard American in order to be live is not real world factors belonging to the CPU-I and in addition it is not asking a lot of that our government, as well as funded by us, to be within those self same numbers.

Some the correct storm preparations still make do with it, however if you get caught avoiding the filing of the government Form 2290, you could be charged 8.5% of the owed amount, likewise just filing past the deadline will undoubtedly mean paying 0.5 percent of the balance in late fees.

And finally, tapping a Roth IRA is definitely one of the useful you goes about a modification of your retirement income planning midstream for an unexpected. It's cheaper to do this; since Roth IRA funds are after-tax funds, you don't pay any penalties or levy. If you don't pay your loan back quickly though, generally really wind up costing you.

-

Tax Attorney In Oregon Or Washington; Does Your Small Business Have 1?

2024년 10월 06일

-

A Tax Pro Or Diy Route - What Type Is Good?

2024년 10월 06일

-

How To Rebound Your Credit Score After A Monetary Disaster!

2024년 10월 06일

-

Paying Taxes Can Tax The Better Of Us

2024년 10월 06일

-

Can I Wipe Out Tax Debt In Going Bankrupt?

2024년 10월 06일

-

2006 Report On Tax Scams Released By Irs

2024년 10월 06일

-

Details Of 2010 Federal Income Taxes

2024년 10월 06일

-

Irs Tax Debt - If Capone Can't Dodge It, Neither Are You Able To

2024년 10월 06일

-

Why What Exactly Is File Past Years Taxes Online?

2024년 10월 06일

-

Tax Planning - Why Doing It Now Is Extremely Important

2024년 10월 06일

-

Where Did You Get Information About Your Polytechnic Exam Center?

2024년 10월 06일

-

How Does Tax Relief Work?

2024년 10월 06일

-

Declaring Bankruptcy When Are Obligated To Pay Irs Tax Debt

2024년 10월 06일

-

Details Of 2010 Federal Income Tax Return

2024년 10월 06일

-

Top Tax Scams For 2007 Based On The Text Irs

2024년 10월 06일

-

When Can Be A Tax Case Considered A Felony?

2024년 10월 06일

-

Learn About Exactly How A Tax Attorney Works

2024년 10월 06일

-

Pay 2008 Taxes - Some Questions About How To Carry Out Paying 2008 Taxes

2024년 10월 06일

-

The New Irs Whistleblower Reward Program Pays Millions For Reporting Tax Fraud

2024년 10월 06일

-

When Is Often A Tax Case Considered A Felony?

2024년 10월 06일