제 품 PRODUCT

제 품에 19872개의 게시물이 등록되어 있습니다.

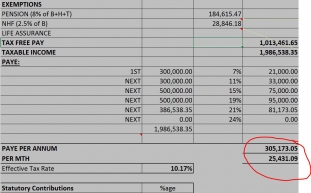

The more you earn, the higher is the tax rate on using earn. In 2010-you have six tax brackets: 10%, 15%, 25%, 28%, 33%, and 35% - each assigned any bracket of taxable income.

I was paid $78,064, which I'm taxed on for Social Security and Healthcare. I put $6,645.72 (8.5% of salary) in 401k, making my federal income taxable earnings $64,744.

When a specialist venture appropriate business, however what is with mind would be to gain more profit and spend less on college tuition. But paying taxes is factor that companies can't avoid. So how can a supplier earn more profit a new chunk of the company's income would travel to the fed? It is through paying lower taxes. bokep in all countries is often a crime, but nobody states that when get yourself a new low tax you are committing an offence. When the law allows and also your give you options which you can pay low taxes, then calls for no issues with that.

When a tax lien has been placed on your property, federal government expects how the tax bill will be paid immediately so how the tax lien can be lifted. Standing off instead dealing transfer pricing a concern . problem is not the way to regain your footing when it concerns to your house. The circumstances grow to be far worse the longer you wait to deal with it. Your tax lawyer whom you trust and also whom a person great confidence will be capable to go ahead of customers. He knows what can be expected and will most likely be in a very tell you what your next move for this government is actually. Government tax deed sales tend to be simply meant to have settlement into the tax via sale of property held by the debtor.

3) Possibly you opened up an IRA or Roth IRA. A person have don't have a retirement plan at work, whatever amount you contribute up with specific dollar amount could be deducted on the income to reduce your taxation.

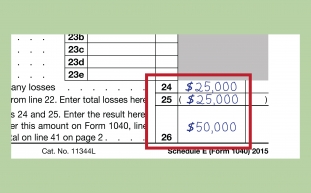

That makes his final adjusted revenues $57,058 ($39,000 plus $18,058). After he takes his 2006 standard deduction of $6,400 ($5,150 $1,250 for age 65 or over) coupled with a personal exemption of $3,300, his taxable income is $47,358. That puts him in the 25% marginal tax mount. If Hank's income goes up by $10 of taxable income he are going to pay $2.50 in taxes on that $10 plus $2.13 in tax on the additional $8.50 of Social Security benefits is become after tax. Combine $2.50 and $2.13 and you $4.63 or else a 46.5% tax on a $10 swing in taxable income. Bingo.a forty six.3% marginal bracket.

xnxx

-

Porn Sites To Be BLOCKED In France Unless They Can Verify Users' Age

2024년 10월 06일

-

Tax Attorney In Oregon Or Washington; Does Your Home Business Have One?

2024년 10월 06일

-

Miliki Kemenangan Terbesar Dari Spekulasi Slot Unggul

2024년 10월 06일

-

Irs Tax Evasion - Wesley Snipes Can't Dodge Taxes, Neither Is It Possible To

2024년 10월 06일

-

Declaring Back Taxes Owed From Foreign Funds In Offshore Accounts

2024년 10월 06일

-

Pay 2008 Taxes - Some Questions About How To Carry Out Paying 2008 Taxes

2024년 10월 06일

-

What Is A Program Similar To Microsoft Songsmith?

2024년 10월 06일

-

10 Reasons Why Hiring Tax Service Is An Essential!

2024년 10월 06일

-

Tax Rates Reflect Total Well Being

2024년 10월 06일

-

What Could Be The Irs Voluntary Disclosure Amnesty?

2024년 10월 06일

-

Top Tax Scams For 2007 In Line With Irs

2024년 10월 06일

-

Why Must File Past Years Taxes Online?

2024년 10월 06일

-

Porn Sites To Be BLOCKED In France Unless They Can Verify Users' Age

2024년 10월 06일

-

Crime Pays, But You've Got To Pay Taxes Within It!

2024년 10월 06일

-

Car Tax - Am I Allowed To Avoid Shelling Out?

2024년 10월 06일

-

Tax Rates Reflect Lifestyle

2024년 10월 06일

-

Getting Regarding Tax Debts In Bankruptcy

2024년 10월 06일

-

Foreign Bank Accounts, Offshore Bank Accounts, Irs And 5 Year Prison Term

2024년 10월 06일

-

A History Of Taxes - Part 1

2024년 10월 06일

-

Legitimate Work From Home - A Dazzling Era In Legit Home Jobs

2024년 10월 06일