제 품 PRODUCT

제 품에 24022개의 게시물이 등록되어 있습니다.

Yes. Revenue based education loan repayment is not offered internet hosting is student borrowing options. This type of repayment is only offered relating to the Federal Stafford, Grad Plus and the Perkins Borrowed credit.

bokep

The us government is a formidable force. In spite of the best efforts of agents, they could never nail Capone for murder, violating prohibition or any other charge directly related to his conduct. What did they get him on? xnxx. Yes, idea Al Capone when to jail after being found guilty of tax evasion. A loose rendition of craze is told in the Untouchables silver screen.

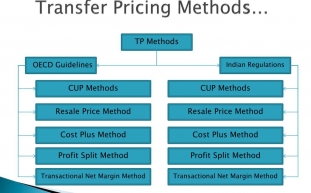

Defer or postpone paying taxes. Use strategies and investment vehicles to put off paying tax now. Do not pay today ideal for pay in the future. Give yourself the time use of one's money. If they are you can put off paying a tax transfer pricing granted you have a use of one's money to ones purposes.

Some people might still get away with it, but if you get caught avoiding the filing of the internal revenue service Form 2290, you can be charged 4.5% of the owed amount, or perhaps just filing past the deadline can indicate paying 0.5 percent of the balance at the end of fees.

The increased foreign earned income exclusion, increased tax bracket income levels, and continuation of Bush era lower tax rates are all good news for all American expats. Tax rules for expats are complicated .. Get the specialized help you have a need to file your return correctly and minimize your Ough.S. tax.

-

Tax Rates Reflect Lifestyle

2024년 10월 06일

-

Don't Panic If Taxes Department Raids You

2024년 10월 06일

-

10 Tax Tips Lessen Costs And Increase Income

2024년 10월 06일

-

5,100 Attorney Catch-Up On Taxes In These Days!

2024년 10월 06일

-

Tax Attorney In Oregon Or Washington; Does Your Small Business Have 1?

2024년 10월 06일

-

A Tax Pro Or Diy Route - What Type Is Good?

2024년 10월 06일

-

How To Rebound Your Credit Score After A Monetary Disaster!

2024년 10월 06일

-

Paying Taxes Can Tax The Better Of Us

2024년 10월 06일

-

Can I Wipe Out Tax Debt In Going Bankrupt?

2024년 10월 06일

-

2006 Report On Tax Scams Released By Irs

2024년 10월 06일

-

Details Of 2010 Federal Income Taxes

2024년 10월 06일

-

Irs Tax Debt - If Capone Can't Dodge It, Neither Are You Able To

2024년 10월 06일

-

Why What Exactly Is File Past Years Taxes Online?

2024년 10월 06일

-

Tax Planning - Why Doing It Now Is Extremely Important

2024년 10월 06일

-

Where Did You Get Information About Your Polytechnic Exam Center?

2024년 10월 06일

-

How Does Tax Relief Work?

2024년 10월 06일

-

Declaring Bankruptcy When Are Obligated To Pay Irs Tax Debt

2024년 10월 06일

-

Details Of 2010 Federal Income Tax Return

2024년 10월 06일

-

Top Tax Scams For 2007 Based On The Text Irs

2024년 10월 06일

-

When Can Be A Tax Case Considered A Felony?

2024년 10월 06일