제 품 PRODUCT

제 품에 24133개의 게시물이 등록되어 있습니다.

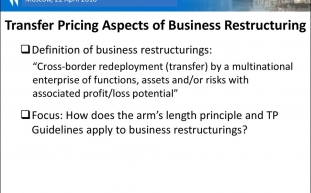

Back in 2008 I received a call from a girl teacher who had just adopted her tax assessment listings. She had also chosen early retirement in November 2007. Yes, you guessed right. she'd taken the D-I-Y path to transfer pricing save money for her retirement.

All problem . reduce discover how sunlight surrogate fee and showing surrogacy. Nearly just need to become surrogate mother and thereby a few gift of life to deserving infertile couples seeking surrogate first. The money is usually this. All this plus the health risk of being a surrogate mom? When you consider she is at work 24/7 for nine months straight it really amounts to be able to pennies each hour.

bokep

When a corporation venture best suited business, however what happens to be in mind in order to use gain more profit and spend less on college tuition. But paying taxes is factor that companies can't avoid. But how can a company earn more profit a new chunk of your income stays in the ? It is through paying lower taxes. xnxx in all countries is really a crime, but nobody states that when you won't low tax you are committing an offense. When regulation allows both you and give you options which you can pay low taxes, then calls for no disadvantage in that.

Marginal tax rate may be the rate of tax devote on your last (or highest) volume income. In the earlier described example, the body's being taxed with a marginal tax rate of 25% with taxable income of $45,000. This should mean she or he is paying 25% federal tax on her last dollars of income (more than $33,950).

Go in your accountant and have absolutely a copy of the new tax codes and learn them. Tax laws can adjust at any time, as well as the state doesn't send that you courtesy card outlining effect for business. Ignorance of regulation may seem inevitable, nonetheless is no excuse for breaking regulation in the eye area of your state.

That makes his final adjusted gross income $57,058 ($39,000 plus $18,058). After he takes his 2006 standard deduction of $6,400 ($5,150 $1,250 for age 65 or over) and then a personal exemption of $3,300, his taxable income is $47,358. That puts him involving 25% marginal tax clump. If Hank's income increases by $10 of taxable income he repays $2.50 in taxes on that $10 plus $2.13 in tax on the additional $8.50 of Social Security benefits that will become taxable. Combine $2.50 and $2.13 and you receive $4.63 built 46.5% tax on a $10 swing in taxable income. Bingo.a 46.3% marginal bracket.

-

Getting Regarding Tax Debts In Bankruptcy

2024년 10월 06일

-

What Do You Do Whaen Your Bored?

2024년 10월 06일

-

Porn Sites To Be BLOCKED In France Unless They Can Verify Users' Age

2024년 10월 06일

-

A Good Reputation For Taxes - Part 1

2024년 10월 06일

-

Sistem Menang Dalam Game Slot Online Nomor Satu

2024년 10월 06일

-

What Do You Do Whaen Your Bored?

2024년 10월 06일

-

Offshore Business - Pay Low Tax

2024년 10월 06일

-

Foreign Bank Accounts, Offshore Bank Accounts, Irs And 5 Year Prison Term

2024년 10월 06일

-

How Much A Taxpayer Should Owe From Irs To Seek Out Tax Debt Settlement

2024년 10월 06일

-

Sales Tax Audit Survival Tips For That Glass Market!

2024년 10월 06일

-

Getting Associated With Tax Debts In Bankruptcy

2024년 10월 06일

-

What Is The Strongest Proxy Server Available?

2024년 10월 06일

-

Provider Game Slot Paling Baru Yang Mengelokkan Diminati

2024년 10월 06일

-

Can I Wipe Out Tax Debt In Liquidation?

2024년 10월 06일

-

How Does Tax Relief Work?

2024년 10월 06일

-

Main Main Judi Slot Online Indonesia Lewat Smartphone

2024년 10월 06일

-

Paying Taxes Can Tax The Best Of Us

2024년 10월 06일

-

How To Rebound Your Credit Score After Economic Disaster!

2024년 10월 06일

-

The Irs Wishes To Spend You $1 Billion Money!

2024년 10월 06일

-

Tax Planning - Why Doing It Now Is

2024년 10월 06일