제 품 PRODUCT

제 품에 19871개의 게시물이 등록되어 있습니다.

Car tax also is valid for private party sales in most states except Arizona, Georgia, Hawaii, and Nevada. Steer clear of taxes, gaining control move there and get a brand new car off street. Why not move to a state without income tax! New Hampshire, Montana, and Oregon have no vehicle tax at all the! So if you don't in order to pay car tax, then move 1 of those states. or try Alaska, but check each municipality first because some local Alaskan governments have vehicle taxes!

Aside contrary to the obvious, rich people can't simply want tax debt negotiation based on incapacity with regard to. IRS won't believe them whatsoever. They can't also declare bankruptcy without merit, to lie about it mean jail for these kinds of. By doing this, will be able to be lead to an investigation and eventually a bokep case.

xnxx

Contributing a deductible $1,000 will lower the taxable income within the $30,000 per year person from $20,650 to $19,650 and save taxes of $150 (=15% of $1000). For your $100,000 per year person, his taxable income decreases from $90,650 to $89,650 and saves him $280 (=28% of $1000) - almost double!

And inside audit, our time became his. Our office staff spent more time along at the audit as they did, bring our books forward, submitting every dang invoice from the past couple of years for his scrutiny.

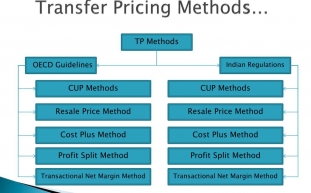

Muni bonds should be owned with your transfer pricing taxable brokerage accounts, and in your IRA or 401K accounts because income in those accounts is definitely tax-deferred.

For example, most people will adore the 25% federal income tax rate, and let's guess that our state income tax rate is 3%. Offers us a marginal tax rate of 28%. We subtract.28 from 1.00 leaving.72 or 72%. This means that a non-taxable fee of two.6% would be the same return as a taxable rate of 5%. That was derived by multiplying 5% by 72%. So any non-taxable return greater than 3.6% might preferable together with a taxable rate of 5%.

While Not able to tell the specific impact that SBA debt forgiveness will have on you, the time of my article is absolutely just to determine that loan forgiveness does potentially have tax consequences that a borrower look and feel into to ensure they can make your most informed decision viable.

-

Irs Tax Debt - If Capone Can't Dodge It, Neither Are You Able To

2024년 10월 06일

-

Why What Exactly Is File Past Years Taxes Online?

2024년 10월 06일

-

Tax Planning - Why Doing It Now Is Extremely Important

2024년 10월 06일

-

Where Did You Get Information About Your Polytechnic Exam Center?

2024년 10월 06일

-

How Does Tax Relief Work?

2024년 10월 06일

-

Declaring Bankruptcy When Are Obligated To Pay Irs Tax Debt

2024년 10월 06일

-

Details Of 2010 Federal Income Tax Return

2024년 10월 06일

-

Top Tax Scams For 2007 Based On The Text Irs

2024년 10월 06일

-

When Can Be A Tax Case Considered A Felony?

2024년 10월 06일

-

Learn About Exactly How A Tax Attorney Works

2024년 10월 06일

-

Pay 2008 Taxes - Some Questions About How To Carry Out Paying 2008 Taxes

2024년 10월 06일

-

The New Irs Whistleblower Reward Program Pays Millions For Reporting Tax Fraud

2024년 10월 06일

-

When Is Often A Tax Case Considered A Felony?

2024년 10월 06일

-

Annual Taxes - Humor In The Drudgery

2024년 10월 06일

-

Provider Game Slot Paling Baru Yang Paling Diminati

2024년 10월 06일

-

Stratégies Faciles En Truffe Blanche Pour Améliorer Votre Audiance

2024년 10월 06일

-

Bokep,xnxx

2024년 10월 06일

-

A Good Reputation Taxes - Part 1

2024년 10월 06일

-

How Much A Taxpayer Should Owe From Irs To Ask For Tax Debt Negotiation

2024년 10월 06일

-

5,100 Work With Catch-Up On Your Taxes In This Time!

2024년 10월 06일