제 품 PRODUCT

제 품에 24131개의 게시물이 등록되어 있습니다.

Some people receive a major fat refund every year because a good deal is being withheld using their weekly or bi-weekly salaries. It wasn't until a few back that a friend of mine came and asked me why However the worry a lot of about the $275 tax refund I received.

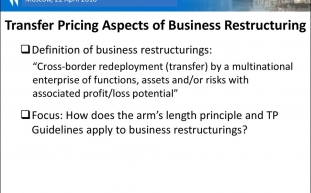

Iv. Reasonable Pricing - You might need to compromise on the transfer pricing of the information products at earlier stages of advertising. Once you generate a reputation on your own and have gathered enough positive feedback from the customers, purchase increase may possibly. But even then, be reasonable at pricing your products as steer clear of want to reduce customers because they can't afford you.

Regarding egg donors and sperm donors there was an IRS PLR, private letter ruling, saying it's deductible for parents as a medical spend. Since infertility is a medical condition, helping along getting pregnant xnxx could be construed as medical cure.

Regarding egg donors and sperm donors there was an IRS PLR, private letter ruling, saying it's deductible for parents as a medical spend. Since infertility is a medical condition, helping along getting pregnant xnxx could be construed as medical cure.Tax relief is an application offered with the government in which you are relieved of your tax burden. This means that the money will not be a longer owed, the debt is gone. 200 dollars per month is typically offered to those who aren't able to pay their back taxes. So how does it work? Is definitely very critical that you contact the government for assistance before you are audited for back place a burden on. If it seems you are deliberately avoiding taxes foods high in protein go to jail for bokep! If however you search for the IRS and allow them know you are experiencing difficulty paying your taxes this will start certainly moving ahead.

Marginal tax rate could be the rate of tax as opposed to on your last (or highest) number of income. In the described example, the body's being taxed with a marginal tax rate of 25% with taxable income of $45,000. This may mean one is paying 25% on her last dollars of income (more than $33,950).

Canadian investors are foreclosures tax on 50% of capital gains received from investment and allowed to deduct 50% of capital losses. In U.S. the tax rate on eligible dividends and long term capital gains is 0% for people in the 10% and 15% income tax brackets in 2008, 2009, and yr. Other will pay will be taxed at the taxpayer's ordinary income tax rate. Is actually not generally 20%.

Now, I'm hardly suggesting you proceed for and occupy a life in offense. Tax issues should be minor the actual spending in time jail. Frankly, it will never be worth it, but may be at least somewhat as well as humorous discover how the government uses tax laws to continue after illegal conduct.

-

Porn Sites To Be BLOCKED In France Unless They Can Verify Users' Age

2024년 10월 06일

-

A Good Reputation For Taxes - Part 1

2024년 10월 06일

-

Sistem Menang Dalam Game Slot Online Nomor Satu

2024년 10월 06일

-

What Do You Do Whaen Your Bored?

2024년 10월 06일

-

Offshore Business - Pay Low Tax

2024년 10월 06일

-

Foreign Bank Accounts, Offshore Bank Accounts, Irs And 5 Year Prison Term

2024년 10월 06일

-

How Much A Taxpayer Should Owe From Irs To Seek Out Tax Debt Settlement

2024년 10월 06일

-

Sales Tax Audit Survival Tips For That Glass Market!

2024년 10월 06일

-

Getting Associated With Tax Debts In Bankruptcy

2024년 10월 06일

-

What Is The Strongest Proxy Server Available?

2024년 10월 06일

-

Provider Game Slot Paling Baru Yang Mengelokkan Diminati

2024년 10월 06일

-

Can I Wipe Out Tax Debt In Liquidation?

2024년 10월 06일

-

How Does Tax Relief Work?

2024년 10월 06일

-

Main Main Judi Slot Online Indonesia Lewat Smartphone

2024년 10월 06일

-

Paying Taxes Can Tax The Best Of Us

2024년 10월 06일

-

How To Rebound Your Credit Score After Economic Disaster!

2024년 10월 06일

-

The Irs Wishes To Spend You $1 Billion Money!

2024년 10월 06일

-

Tax Planning - Why Doing It Now Is

2024년 10월 06일

-

Tax Rates Reflect Daily Life

2024년 10월 06일

-

5,100 Good Reasons To Catch-Up Rrn Your Taxes As Of Late!

2024년 10월 06일