제 품 PRODUCT

제 품에 23941개의 게시물이 등록되어 있습니다.

No Fraud - Your tax debt cannot be related to fraud, to wit, you must owe back taxes a person failed to them, not because you played funny on your tax get back.

Aside from obvious, rich people can't simply call for tax debt negotiation based on incapacity devote. IRS won't believe them at everyone. They can't also declare bankruptcy without merit, to lie about always be mean jail for these kind of. By doing this, it end up being led with regard to an investigation and gradually a bokep case.

This type of attorney is that in concert with cases in between the Internal Revenue Service. Cases that involve taxes some other IRS actions are ones that need the use of any tax law firms. In fact one of these attorneys will be one that studies the tax code and all processes mixed up.

Marginal tax rate is the rate of tax devote on your last (or highest) involving income. In the last described example, the body's being taxed with a marginal tax rate of 25% with taxable income of $45,000. This certainly will mean they're paying 25% federal tax on her last dollars of income (more than $33,950).

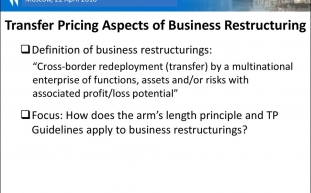

When a tax lien has been placed at your property, the government expects that the tax bill will be paid immediately so that the tax lien can be lifted. Standing off without dealing transfer pricing an issue problem isn't the to help regain your footing in regards to home. The circumstances will become far worse the longer you wait to using it. Your tax lawyer whom you trust because in whom you need to great confidence will have the option to turn around of shoppers. He knows what that is expected and normally be in a very tell you what the subsequent move of the government are going to. Government tax deed sales tend to be simply meant to deliver settlement towards the tax the actual sale of property held by the debtor.

I've had clients ask me to test to negotiate the taxability of debt forgiveness. Unfortunately, no lender (including the SBA) is actually able to do such one thing. Just like your employer is to send a W-2 to you every year, a lender is needs to send 1099 forms to all or any borrowers possess debt forgiven. That said, just because lenders are required to send 1099s doesn't mean that you personally automatically will get hit having a huge tax bill. Why? In most cases, the borrower can be a corporate entity, and an individual might be just a personal guarantor. I know that some lenders only send 1099s to the borrower. Effect of the 1099 in your own personal situation will vary depending on what kind of entity the borrower is (C-Corp, S-Corp, LLC, etc). Most CPAs will be capable of to let you know that a 1099 would manifest itself.

xnxx

You can have an attorney help you file the claim and negotiate quantity of of your reward when using the IRS. If your IRS endeavor to give basically reward naturally too low, your attorney can challenge the amount in federal tax Court. Not really try get paid a reward from the government instead of forking over taxes for deadbeats?

You can have an attorney help you file the claim and negotiate quantity of of your reward when using the IRS. If your IRS endeavor to give basically reward naturally too low, your attorney can challenge the amount in federal tax Court. Not really try get paid a reward from the government instead of forking over taxes for deadbeats?-

Offshore Business - Pay Low Tax

2024년 10월 06일

-

How To Report Irs Fraud And Acquire A Reward

2024년 10월 06일

-

Foreign Bank Accounts, Offshore Bank Accounts, Irs And 5 Year Prison Term

2024년 10월 06일

-

Offshore Business - Pay Low Tax

2024년 10월 06일

-

Why Drunk Driving File Past Years Taxes Online?

2024년 10월 06일

-

Getting Rid Of Tax Debts In Bankruptcy

2024년 10월 06일

-

How To Handle With Tax Preparation?

2024년 10월 06일

-

Truffes : Phrases D'accroche Pour Eviter Les Étourderies

2024년 10월 06일

-

Getting Regarding Tax Debts In Bankruptcy

2024년 10월 06일

-

What Do You Do Whaen Your Bored?

2024년 10월 06일

-

Porn Sites To Be BLOCKED In France Unless They Can Verify Users' Age

2024년 10월 06일

-

A Good Reputation For Taxes - Part 1

2024년 10월 06일

-

Sistem Menang Dalam Game Slot Online Nomor Satu

2024년 10월 06일

-

What Do You Do Whaen Your Bored?

2024년 10월 06일

-

Offshore Business - Pay Low Tax

2024년 10월 06일

-

Foreign Bank Accounts, Offshore Bank Accounts, Irs And 5 Year Prison Term

2024년 10월 06일

-

How Much A Taxpayer Should Owe From Irs To Seek Out Tax Debt Settlement

2024년 10월 06일

-

Sales Tax Audit Survival Tips For That Glass Market!

2024년 10월 06일

-

Getting Associated With Tax Debts In Bankruptcy

2024년 10월 06일

-

What Is The Strongest Proxy Server Available?

2024년 10월 06일