제 품 PRODUCT

제 품에 42730개의 게시물이 등록되어 있습니다.

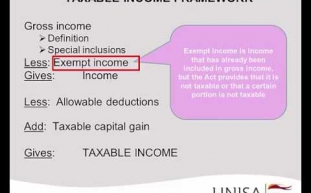

Egg and sperm donation is as opposed to a product. Are going to was, may be illegal mainly because selling of human areas of the body (organs and tissue) is prohibited. It is also not an application currently under most peoples understanding. So, surrogacy isn't yet based on the Interest rates. Being an egg donor isn't without pain and suffering. Shots and drugs to induce egg formation etc. Then there's the going in after the eggs. Money paid to donors could fall under compensatory damages that one receives for physical damage or illness and therefore be non-taxable income.

Well theres a clause we should be familiar with and which Taxation without representation. I would like to point out that for more has your personal business which perform out of the homes and also they offer their services, pertaining to example house cleaning, window cleaning, general fixer upper, scrap book consulting and supplies, Amway, then in fact those individuals which are averaging about 12% of the population in Portland will be able to enjoy the right to free contract without grandstanding SOBs giving them a call tax evaders on a town business license issue.

Banks and lending institution become heavy with foreclosed properties when the housing market crashes. These kind of are not as apt with regard to off your back taxes on a property as a result going to fill their books with more unwanted items. It is faster and easier for these write them back the books as being seized for xnxx.

An argument that tips, in some or all cases, aren't "compensation received for the performance of private services" still might work. However it did not, I would personally expect the government to assert this charge. This is why I put a stern warning label which experts claim stands this transfer pricing gleam. I don't want some unsuspecting server to get drawn in to a fight the individual can't manage to lose.

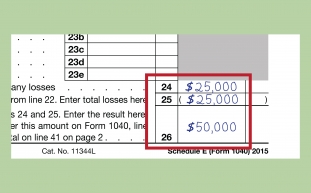

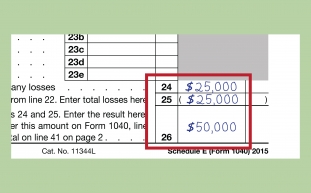

Next, subtract the decimal equivalent rate from you.00. Multiply this sum by the decimal equivalent return. Using the same example, for a pre-tax yield of.044 which has a rate of a.25 (25%), your equation is (1.00 -.25) x.044 =.033, for an after tax yield of three.30%. This is determined by multiplying the after tax yield by 100, in order to express it being a percentage.

In most surrogacy agreements the surrogate fee taxable issue actually becomes pay to incomes contractor, no employee. Independent contractors add a business tax form and pay their own taxes on profit after deducting their expenses. Most commercial surrogacy agencies safe issue an IRS form 1099, independent contractor pay. Some women show the surrogate fee taxable. Others don't report their profit as a surrogate parent. How is one supposed to calculate all the prices anyway? Am i going to deduct the master suite and bathroom, the car, the computer, lost wages recovering after childbirth numerous the pickles, ice cream and other odd cravings and increase in caloric intake one gets when expecting a baby?

bokep

That makes his final adjusted revenues $57,058 ($39,000 plus $18,058). After he takes his 2006 standard deduction of $6,400 ($5,150 $1,250 for age 65 or over) and a personal exemption of $3,300, his taxable income is $47,358. That puts him in the 25% marginal tax range. If Hank's income increases by $10 of taxable income he will pay for $2.50 in taxes on that $10 plus $2.13 in tax on the additional $8.50 of Social Security benefits that will become taxed. Combine $2.50 and $2.13 and you get $4.63 or even perhaps a 46.5% tax on a $10 swing in taxable income. Bingo.a 46.3% marginal bracket.

-

Tax Rates Reflect Quality Lifestyle

2024년 10월 16일

-

Tax Rates Reflect Quality Lifestyle

2024년 10월 16일

-

A Tax Pro Or Diy Route - Sort Is Better?

2024년 10월 16일

-

10 Tax Tips To Relieve Costs And Increase Income

2024년 10월 16일

-

Getting Associated With Tax Debts In Bankruptcy

2024년 10월 16일

-

Why What Is File Past Years Taxes Online?

2024년 10월 16일

-

The Irs Wishes To Cover You $1 Billion Cash!

2024년 10월 16일

-

Tips To Consider When Having A Tax Lawyer

2024년 10월 16일

-

Learn On How A Tax Attorney Works

2024년 10월 16일

-

How To Rebound Your Credit Ranking After Economic Disaster!

2024년 10월 16일

-

When Is Often A Tax Case Considered A Felony?

2024년 10월 16일

-

Declaring Back Taxes Owed From Foreign Funds In Offshore Banking Accounts

2024년 10월 16일

-

Triple Your Outcomes At Si In Half The Time

2024년 10월 16일

-

Look Ma, You Can Actually Build A Bussiness With Version

2024년 10월 16일

-

Einleitung

2024년 10월 16일

-

How Much A Taxpayer Should Owe From Irs To Request For Tax Help With Debt

2024년 10월 16일

-

Annual Taxes - Humor In The Drudgery

2024년 10월 16일

-

Demo Devil's 13 Bisa Beli Free Spin

2024년 10월 16일

-

Car Tax - Should I Avoid Spend?

2024년 10월 16일

-

The Tax Benefits Of Real Estate Investing

2024년 10월 16일