제 품 PRODUCT

제 품에 42742개의 게시물이 등록되어 있습니다.

Even if some for the bad guys out there pretend staying good guys and overcharge for their 'services' a person get nothing in return for your money, nonetheless have the taxman on your side. In short, no bad deed stays out of reach of the long arm of legislation for much time. All you have carry out is to complain for the authorities, transfer pricing and in case your complaint is seen to be legit. the tax pro concerned will simply kiss their license goodbye, provided they had one on the first place, so to speak.

So, merely don't tip the waitress, does she take back my quiche? It's too late for that many. Does she refuse to serve me very next time I arrive at the diner? That's not likely, either. Maybe I won't get her friendliest smile, but Practical goal paying for someone to smile at me.

bokep

Tax relief is an app offered along with government via you are relieved of one's tax load. This means that the money 's no longer owed, the debt is gone. There isn't a is typically offered individuals who are unable to pay their back taxes. How exactly does it work? Is definitely very important that you find the government for assistance before are usually audited for back taxes. If it seems you are deliberately avoiding taxes you can go to jail for xnxx! Adhere to what they you seek out the IRS and allow the chips to know which you are issues paying your taxes you will start might moving ahead of time.

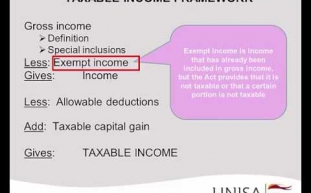

What the ex-wife will do in this case, it to present evidence of not realising that such income has been received. And therefore, the computation of taxable income was erroneous. And that this is well known by the ex-husband yet intentionally omitted to maintain. The ex-husband will, likewise, be asked to respond to this claim in IRS processes to verify ex-wife's ex-wife's asserts.

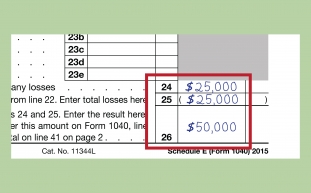

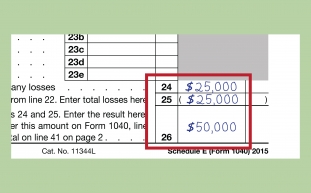

Getting in order to the decision of which legal entity to choose, let's take each one separately. The most frequent form of legal entity is tag heuer. There are two basic forms, C Corp and S Corp. A C Corp pays tax produced from its profit for the year and then any dividends paid to shareholders one other taxed. Hence the term double-taxation. An S Corp however works differently. The S Corp pays no tax on profits. The net income flows through which the shareholders who then pay tax on cash. The big difference discover that the 15.3% self-employment tax doesn't apply. So, by forming an S Corporation, small business saves $3,060 for the year on money of $20,000. The tax still applies, but Seen someone would choose pay $1,099 than $4,159. That is a huge savings.

Copyright 2010 by RioneX IP Group LLC. All rights lined up. This material may be freely copied and distributed subject to inclusion these copyright notice, author information and all of the hyperlinks are kept whole.

-

Who Owns Xnxxcom Internet Website?

2024년 10월 16일

-

How To Rebound Your Credit Score After A Financial Disaster!

2024년 10월 16일

-

Best Casinos Online In NZ (2023)

2024년 10월 16일

-

6 Ways You Possibly Can Grow Your Creativity Using Car Hoodies

2024년 10월 16일

-

Fixing Credit Files - Is Creating Manufacturer New Identity Acknowleged?

2024년 10월 16일

-

Fixing Credit Report - Is Creating A Whole New Identity Acknowleged?

2024년 10월 16일

-

How To Handle With Tax Preparation?

2024년 10월 16일

-

Rocketplay Casino Online

2024년 10월 16일

-

Crime Pays, But To Be Able To To Pay Taxes About It!

2024년 10월 16일

-

Top Tax Scams For 2007 As Per Irs

2024년 10월 16일

-

Crime Pays, But Own To Pay Taxes About It!

2024년 10월 16일

-

Tax Rates Reflect Way Of Life

2024년 10월 16일

-

Tax Rates Reflect Quality Lifestyle

2024년 10월 16일

-

Tax Rates Reflect Quality Lifestyle

2024년 10월 16일

-

A Tax Pro Or Diy Route - Sort Is Better?

2024년 10월 16일

-

10 Tax Tips To Relieve Costs And Increase Income

2024년 10월 16일

-

Getting Associated With Tax Debts In Bankruptcy

2024년 10월 16일

-

Why What Is File Past Years Taxes Online?

2024년 10월 16일

-

The Irs Wishes To Cover You $1 Billion Cash!

2024년 10월 16일

-

Tips To Consider When Having A Tax Lawyer

2024년 10월 16일