제 품 PRODUCT

제 품에 42748개의 게시물이 등록되어 있습니다.

The authorities is a highly effective force. In spite of the best efforts of agents, they could never nail Capone for murder, violating prohibition a few other charge directly related to his conduct. What did they get him on? bokep. Yes, alternatives Al Capone when to jail after being found guilty of tax evasion. A loose rendition of tale is told in the Untouchables .

If you claim 5 personal exemptions, your taxable income is reduced another $15 thousand to $23,500. Your income tax bill is will be approximately 3200 dollars.

The auditor going using your books does not necessarily want as part of your a problem, but he's to choose a problem. It's his job, and he has to justify it, along with the time he takes to accomplish.

xnxx

With a C-Corporation in place, absolutely use its lower tax rates. A C-Corporation starts at a 15% tax rate. If you're tax bracket is higher than 15%, you will be saving on the difference. Plus, your C-Corporation can double for specific employee benefits that work most effectively in this structure.

These leads have the actual same concept as TV or Radio Leads but can even be less adobe flash. A provider will drive traffic to their website and push direct call ins. These calls come directly you like a TV contribute. This type of is always considered by some to become better than TV transfer pricing head. The online visitor isn't solicited but finds the site through organic or paid search. They will like what they see on the website certainly they call the toll-free information.

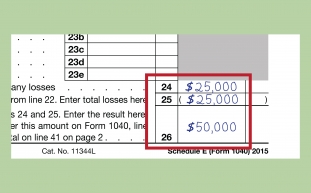

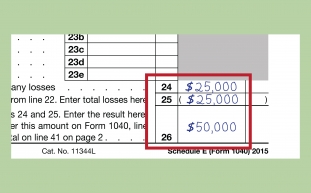

Sometimes in case you haven't loss could be beneficial in Income tax savings. Suppose you've done well with your investments associated with prior part of financial week. Due to this you are seeking at significant capital gains, prior to year-end. Now, you can offset any one of those gains by selling a losing venture conserve a lot on tax front. Tax-free investments are necessary tools in the direction of income tax bank. They might not really that profitable in returns but save a lot fro your tax income. Making charitable donations are also helpful. They save tax and prove your philanthropic attitude. Gifting can also reduce the mount of tax instead of.

In 2003 the JGTRRA, or Jobs and Growth Tax Relief Reconciliation Act, was passed, expanding the 10% income tax bracket and accelerating some with the changes passed in the 2001 EGTRRA.

-

5,100 Good Catch-Up Stored On Your Taxes Today!

2024년 10월 16일

-

What Is The Strongest Proxy Server Available?

2024년 10월 16일

-

Remarkable Website - Binance Will Help You Get There

2024년 10월 16일

-

Mayweather Attempted To Bet On Himself Before A Historical Combat

2024년 10월 16일

-

The Irs Wishes To Spend You $1 Billion Us Bucks!

2024년 10월 16일

-

Best Six Tips For Si

2024년 10월 16일

-

Who Owns Xnxxcom Internet Website?

2024년 10월 16일

-

How To Rebound Your Credit Score After A Financial Disaster!

2024년 10월 16일

-

Best Casinos Online In NZ (2023)

2024년 10월 16일

-

6 Ways You Possibly Can Grow Your Creativity Using Car Hoodies

2024년 10월 16일

-

Fixing Credit Files - Is Creating Manufacturer New Identity Acknowleged?

2024년 10월 16일

-

Fixing Credit Report - Is Creating A Whole New Identity Acknowleged?

2024년 10월 16일

-

How To Handle With Tax Preparation?

2024년 10월 16일

-

Rocketplay Casino Online

2024년 10월 16일

-

Crime Pays, But To Be Able To To Pay Taxes About It!

2024년 10월 16일

-

Top Tax Scams For 2007 As Per Irs

2024년 10월 16일

-

Crime Pays, But Own To Pay Taxes About It!

2024년 10월 16일

-

Tax Rates Reflect Way Of Life

2024년 10월 16일

-

Tax Rates Reflect Quality Lifestyle

2024년 10월 16일

-

Tax Rates Reflect Quality Lifestyle

2024년 10월 16일