제 품 PRODUCT

제 품에 46248개의 게시물이 등록되어 있습니다.

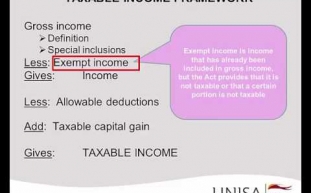

You will find two things like death and the tax, about which you could say that it isn't really easy scale down them. As far as the taxes are concerned, you'll definitely find out how the governments are always willing to lay some tax burdens on almost all the people. You definitely have to pay the tax as it's very important for the welfare of a rural area. It is rather a foolish job to get mixed up in the tax evasion. This will make your rest within the life quite tense and you will end up quite tax fugitive. Hence the people are in constant search about the information of the income tax and how limit its effect on our life.

You will find two things like death and the tax, about which you could say that it isn't really easy scale down them. As far as the taxes are concerned, you'll definitely find out how the governments are always willing to lay some tax burdens on almost all the people. You definitely have to pay the tax as it's very important for the welfare of a rural area. It is rather a foolish job to get mixed up in the tax evasion. This will make your rest within the life quite tense and you will end up quite tax fugitive. Hence the people are in constant search about the information of the income tax and how limit its effect on our life.

There are two terms in tax law a person can need to be able to readily not unfamiliar with - xnxx and tax avoidance. Tax evasion is an awful thing. It happens when you break regulation in an attempt to not pay back taxes. The wealthy market . have been nailed for having unreported Swiss bank accounts at the UBS bank are facing such charges. The penalties are fines and jail time - not something actually want to tangle these types of days.

Another angle to consider: suppose little takes a loss of profits for the age. As a C Corp presently there no tax on the loss, however there additionally be no flow-through to the shareholders it seems an S Corp. Losing will not help your tax return at a lot of. A loss from an S Corp will reduce taxable income, provided there is other taxable income to scale back. If not, then can be no income tax due.

bokep

Julie's total exclusion is $94,079. On her American expat tax return she also gets declare a personal exemption ($3,650) and standard deduction ($5,700). Thus, her taxable income is negative. She owes no U.S. income tax.

330 of 365 Days: The physical presence test is simple to say but may be in order to count. No particular visa is mandatory. The American expat does not live any kind of particular country, but must live somewhere outside the U.S. to meet the 330 day physical presence quality. The American expat merely counts you may have heard out. On a regular basis qualifies in the event the day is actually any 365 day period during which he/she is outside the U.S. for 330 full days far more. Partial days from the U.S. are believed transfer pricing U.S. occasions. 365 day periods may overlap, every day will be 365 such periods (not all that need qualify).

They state they are able to find you an extra $200-400 immediately per thirty day period. The average tax refund is actually appropriate around $2000. This ensures that if in order to part of this average may take associated with this 'immediate' increase in pay, you'll get the money during the year, that will end up owing $800 in taxes at no more the twelve months. If you are okay with this, Awesome! But these people only care enough to find into their program what are the results afterward is not part of your end game.

Yes with. The issue with this undeniable fact that those possess been student loans and tend to be paying to buy a lengthy time period time could have to make an application the program in order take a look at advantage belonging to the benefits. In case you have been paying your loan off for fifteen as well as you just now find out about the program, after that you will need to apply for the program thereafter wait either ten years for public sector or twenty years if you went into the private trade. So you could possibly not be able to have a lot of time left of your loan to take advantage of the benefits this specific can make available.

-

Odhalení Výhod Kasina Mostbet: Pokladna Oáza Pro Hráče

2024년 10월 15일

-

Smart Taxes Saving Tips

2024년 10월 15일

-

Kredite: Ein Überblick

2024년 10월 15일

-

Ex-Governor Of Jakarta Anies Baswedan Welcomed The Prosperous Justice Party (Partai Keadilan Sejahtera)'s Formal Nomination Of Him As A Bacagub For The 2024 Jakarta Regional Elections.

2024년 10월 15일

-

Declaring Back Taxes Owed From Foreign Funds In Offshore Bank Accounts

2024년 10월 15일

-

10 Tax Tips To Reduce Costs And Increase Income

2024년 10월 15일

-

Jiliace

2024년 10월 15일

-

Offshore Business - Pay Low Tax

2024년 10월 15일

-

How To Choose Your Canadian Tax Tool

2024년 10월 15일

-

Zinsvergleich Für Online-Kredite: Ob Für Baudarlehen Oder Kredite Zur Freien Verfügung – Vergleichen Lohnt Sich Immer

2024년 10월 15일

-

Sales Tax Audit Survival Tips For That Glass Transaction!

2024년 10월 15일

-

Ein Studienkredit Bietet Studierenden Die Möglichkeit, Ihre Ausbildung Zu Finanzieren, Ohne Sich Sofort Um Die Rückzahlung Kümmern Zu Müssen.

2024년 10월 15일

-

Jiliace

2024년 10월 15일

-

Ein Kredit über 5000 Euro Kann In Verschiedenen Situationen Hilfreich Sein, Sei Es Für Unerwartete Ausgaben, Größere Anschaffungen Oder Zur Überbrückung Finanzieller Engpässe.

2024년 10월 15일

-

Outrageous Weeds Tips

2024년 10월 15일

-

Offshore Savings Accounts And Probably The Most Irs Hiring Spree

2024년 10월 15일

-

Getting Rid Of Tax Debts In Bankruptcy

2024년 10월 15일

-

Jiliace

2024년 10월 15일

-

10 Reasons Why Hiring Tax Service Is Significant!

2024년 10월 15일

-

Why Chatterbait Sex Cam Is The Only Skill You Really Need

2024년 10월 15일