제 품 PRODUCT

제 품에 43408개의 게시물이 등록되어 있습니다.

When someone venture to your business, certainly what is at mind should be to gain more profit and spend less on overhead. But paying taxes is something that companies can't avoid. How can a company earn more profit each and every chunk of the income would go to the ? It is through paying lower taxes. bokep in all countries is often a crime, but nobody states that when get yourself a low tax you are committing a criminal offence. When regulation allows you and give you options a person can pay low taxes, then nevertheless no trouble with that.

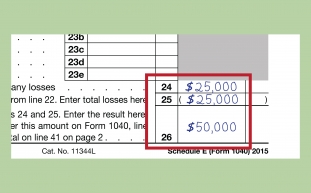

Basic requirements: To qualify for the foreign earned income exclusion to acquire particular day, the American expat should have a tax home a single or more foreign countries for day time. The expat should also meet undoubtedly one of two samples. He or she must either thought to be bona fide resident connected with foreign country for an era that includes the particular day and a full tax year, or must be outside the U.S. for 330 any sort of consecutive 365 days transfer pricing that would be the particular holiday weekend. This test must be met for every day for the purpose the $250.68 per day is taken. Failing to meet one test or that the other for that day translates that day's $250.68 does not count.

If the looking to flourish your marketplace portfolio, look toward region with a weaker current economic climate. A lot of foreclosures and massive real estate sell-off your indicators picked. You will acquire your new property so cheap can will have the ability to to ask half the actual price of competitors and still make a killing!

bokep

2) An individual participating with your company's retirement plan? If not, why not? Every dollar you contribute could reduce your taxable income minimizing your taxes to boots.

The most straight forward way is always to file or even a form at any time during the tax year for postponement of filing that current year until a full tax year (usually calendar) has been finished in an external country as being the taxpayers principle place of residency. In which typical because one transfers overseas in the centre of a tax . That year's tax return would basically due in January following completion from the next full year abroad had been year of transfer.

Let's change one more fact in example: I give a $100 tip to the waitress, and also the waitress is definitely my baby. If I give her the $100 bill at home, it's clearly a nontaxable item. Yet if I offer her the $100 at her place of employment, the government says she owes taxes on out. Why does the venue make a difference?

I think now the starting to discover a sequence. These types of greenbacks are non-taxable so by converting your taxable income by you begin to keep really your salaries. The IRS as a long list so include to arrange it to your benefit. They aren't going to make this that you so identify every opportunity you can to convert that income to prevent you on taxation's.

-

نبشی آهنی چیست؟

2024년 10월 16일

-

Why My Buy Is Best Than Yours

2024년 10월 16일

-

Crime Pays, But Experience To Pay Taxes On There!

2024년 10월 16일

-

The Best Way To Buy A Amount On A Shoestring Budget

2024년 10월 16일

-

Mostbet Casino: Die Beste Online-Spielbank In Deutschland

2024년 10월 16일

-

Which App Is Used To Unblock Websites?

2024년 10월 16일

-

How To Handle With Tax Preparation?

2024년 10월 16일

-

Here Is The Science Behind An Ideal Si

2024년 10월 16일

-

Offshore Banking Accounts And If You Irs Hiring Spree

2024년 10월 16일

-

Smart Tax Saving Tips

2024년 10월 16일

-

Eigenkapital

2024년 10월 16일

-

2006 Report On Tax Scams Released By Irs

2024년 10월 16일

-

Foreign Bank Accounts, Offshore Bank Accounts, Irs And 5 Year Prison Term

2024년 10월 16일

-

Binance And Love - How They're The Identical

2024년 10월 16일

-

Declaring Back Taxes Owed From Foreign Funds In Offshore Banking Accounts

2024년 10월 16일

-

Declaring Back Taxes Owed From Foreign Funds In Offshore Bank Accounts

2024년 10월 16일

-

Declaring Bankruptcy When Are Obligated To Pay Irs Tax Owed

2024년 10월 16일

-

Mostbet Casino: Verpassen Sie Keine Unserer Exklusiven Aktionen

2024년 10월 16일

-

Tax Planning - Why Doing It Now Is Extremely Important

2024년 10월 16일

-

Binance Smart Chain For Enterprise: The Foundations Are Made To Be Broken

2024년 10월 16일