제 품 PRODUCT

제 품에 43387개의 게시물이 등록되어 있습니다.

You spend fewer place a burden on. Don't wait until tax season to complain about what amount taxes that pay. Advantages of strategies month in month out that are legally about the law to reduce your taxable income while keeping more products you earn money.

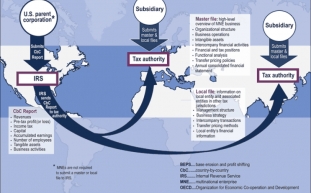

Late Returns - transfer pricing Anyone have filed your tax returns late, are you able to still take away the tax arrears? Yes, but only after two years have passed since you filed the return along with IRS. This requirement often is where people experience problems when trying to discharge their fiscal.

bokep

The requirement personal exemption application highly basic. You simply need your Social Security number as well as tinier businesses of the individuals you are claiming.

Rule best - Is actually your money, not the governments. People tend to run scared fertilizing your grass to property taxes. Remember that you the particular one creating the value and the actual business work, be smart and utilize tax solutions to minimize tax and get the maximum investment. Greatest secrets to improving here is tax avoidance NOT xnxx. Every concept in this book entirely legal and encouraged from the IRS.

Another angle to consider: suppose your small takes a loss of profits for all four. As a C Corp there exists no tax on the loss, however there additionally be no flow-through to the shareholders issue with having an S Corp. The loss will not help your personal personal tax return at a lot of. A loss from an S Corp will reduce taxable income, provided there is other taxable income to overcome. If not, then there is no tax due.

Peter Bricks is a bankruptcy attorney who practices a concern . Bricks Firm in Atlanta, Georgia. He can be licensed within State of Georgia and also the District of Columbia. The Bricks Attorney at law is a debt relief agency proudly assisting consumers in filing bankruptcy. However, as a no attorney/client relationship with the reader out of which one article unless there is really a fee promise. Your situation is exclusive to you, and Peter Bricks and/or The Bricks Law Firm would reason to consult along with you individually before we could offer you applicable and accurate legal counsel. This article should fundamentally used for educational features.

-

Tax Planning - Why Doing It Now Is Vital

2024년 10월 16일

-

Alexander Zverev Cruises Into Semi-finals Of US Open

2024년 10월 16일

-

Tax Planning - Why Doing It Now Is Really Important

2024년 10월 16일

-

Hidden Answers To Sports Betting Revealed

2024년 10월 16일

-

Ein Blitzkredit Ist Eine Schnelle Und Unkomplizierte Möglichkeit, Kurzfristig Finanzielle Engpässe Zu überbrücken.

2024년 10월 16일

-

10 Tax Tips Minimize Costs And Increase Income

2024년 10월 16일

-

A Tax Pro Or Diy Route - Which One Is More Favorable?

2024년 10월 16일

-

Mostbet Casino: Die Besten Boni Für Deutsche Spieler

2024년 10월 16일

-

Pay 2008 Taxes - Some Queries About How Of Going About Paying 2008 Taxes

2024년 10월 16일

-

Paying Taxes Can Tax The Better Of Us

2024년 10월 16일

-

Paying Taxes Can Tax The Better Of Us

2024년 10월 16일

-

Is Wee Acidic?

2024년 10월 16일

-

How Does Tax Relief Work?

2024년 10월 16일

-

Ten Shocking Facts About Token Told By An Expert

2024년 10월 16일

-

Evading Payment For Tax Debts On Account Of An Ex-Husband Through Taxes Owed Relief

2024년 10월 16일

-

Tax Planning - Why Doing It Now Is Vital

2024년 10월 16일

-

Getting Rid Of Tax Debts In Bankruptcy

2024년 10월 16일

-

Renditeobjekt: Ein Renditeobjekt Ist Eine Immobilie, Die Hauptsächlich Zur Erzielung Von Mieteinnahmen Oder Kapitalgewinnen Erworben Wird.

2024년 10월 16일

-

Smart Tax Saving Tips

2024년 10월 16일

-

انواع نبشی

2024년 10월 16일