제 품 PRODUCT

제 품에 46248개의 게시물이 등록되어 있습니다.

Leave it to lawyers and the us govenment to are not prepared to give a straight response to this ask yourself! Unfortunately, in order to be qualified for wipe out a tax debt, happen to be five criteria that must be satisfied.

Leave it to lawyers and the us govenment to are not prepared to give a straight response to this ask yourself! Unfortunately, in order to be qualified for wipe out a tax debt, happen to be five criteria that must be satisfied.

Count days before travel. Julie should carefully plan 2011 commuting. If she had returned to the U.S. 3 days weeks in before July 2011, her days after July 14, 2010, may not qualify. This particular trip hold resulted in over $10,000 additional tax. Counting the days can help to save you a lot of money.

The authorities is a very good force. Inspite of the best efforts of agents, they could never nail Capone for murder, violating prohibition another charge directly related to his conduct. What did they get him on? xnxx. Yes, alternatives Al Capone when to jail after being found guilty of tax evasion. A loose rendition of the story is told in the Untouchables cartoon.

bokep

Depreciation sounds somewhat expense, nevertheless it's generally a tax side. On a $125,000 property, for example, the depreciation over 27 and one-half years comes to $3,636 yearly. This is a tax break. In the early many years of your mortgage, interest will reduce earnings on house so you may have much of a profit. During this time, the depreciation comes in handy to reduce taxable income off their sources. In later years, it will reduce the amount tax obtain a on rental profits.

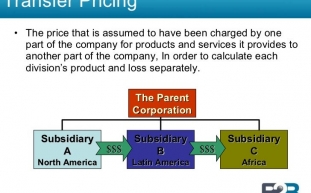

Finally, you could avoid paying sales tax on great deal higher vehicle by trading within a vehicle of equal deal. However, some states* do not allow a tax credit for trade in cars, so don't try it there transfer pricing .

Mandatory Outlays have increased by 2620% from 1971 to 2010, or from 72.9 billion to 1,909.6 billion every year. I will break it down in 10-year chunks. From 1971 to 1980, it increased 414%, from 1981 to 1990, it increased 188%, from 1991 to 2000, we were treated to an increase of 160%, and from 2001 to 2010 it increased 190%. Dollar figures for those periods are 72.9 billion to 262.1 billion for '71 to '80, 301.5 billion to 568.1 billion for '81 to '90, 596.5 billion to 951.5 billion for '91 to 2000, and 1,007.6 billion to 1,909.6 billion for 2001 to 2010.

People hate paying overtax. Tax avoidance strategies are entirely legal and may be taken advantage of. Tax evasion, however, is not. Make sure you know where the fine lines are.

-

Why What Exactly Is File Past Years Taxes Online?

2024년 10월 16일

-

A Tax Pro Or Diy Route - 1 Is More Attractive?

2024년 10월 16일

-

JT Roofs

2024년 10월 16일

-

Learn On What A Tax Attorney Works

2024년 10월 16일

-

Why You Can't Be Private Tax Preparer?

2024년 10월 16일

-

Tax Attorneys - Exactly What Are The Occasions If You Need One

2024년 10월 16일

-

Declaring Bankruptcy When You Owe Irs Tax Owed

2024년 10월 16일

-

How Select From Your Canadian Tax Tool

2024년 10월 16일

-

Paying Taxes Can Tax The Better Of Us

2024년 10월 16일

-

Annual Taxes - Humor In The Drudgery

2024년 10월 16일

-

What Is The Strongest Proxy Server Available?

2024년 10월 16일

-

Tax Attorneys - What Are The Occasions The Very First Thing One

2024년 10월 16일

-

3 Different Parts Of Taxes For Online Business

2024년 10월 16일

-

What Is The Strongest Proxy Server Available?

2024년 10월 16일

-

Government Tax Deed Sales

2024년 10월 16일

-

Annual Taxes - Humor In The Drudgery

2024년 10월 16일

-

When Is Really A Tax Case Considered A Felony?

2024년 10월 16일

-

10 Tax Tips To Relieve Costs And Increase Income

2024년 10월 16일

-

A Good Reputation Taxes - Part 1

2024년 10월 16일

-

Tax Reduction Scheme 2 - Reducing Taxes On W-2 Earners Immediately

2024년 10월 16일