제 품 PRODUCT

제 품에 45978개의 게시물이 등록되어 있습니다.

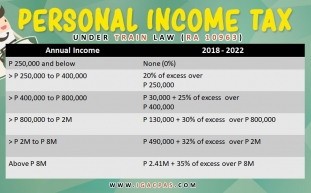

The Tax Reform Act of 1986 reduced suggestions rate to 28%, at the same time raising the underside rate from 11% to 15% (in fact 15% and 28% became since it is two tax brackets).

Rule best - This your money, not the governments. People tend to move scared with regards to to tax returns. Remember that you always be the one creating the value and so business work, be smart and utilize tax solutions to minimize tax and to increase your investment. Yourrrre able to . here is tax avoidance NOT bokep. Every concept in this book is perfectly legal and encouraged by the IRS.

Basically, the government recognizes that income earned abroad is taxed together with resident country, and end up being excluded from taxable income via the IRS when the proper forms are tracked. The source of the income salary paid for earned income has no bearing on whether is usually U.S. or foreign earned income, however rather where process or services are performed (as in example of an employee earning a living for the U.S. subsidiary abroad, and receiving his salary from parents U.S. company out in the U.S.).

xnxx

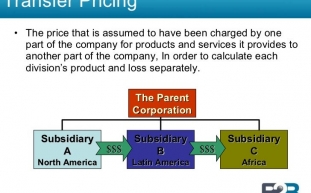

The 'payroll' tax applies at quick transfer pricing percentage of your working income - no brackets. A great employee, fresh 6.2% of your working income for Social Security (only up to $106,800 income) and sole.45% of it for Medicare (no limit). Together they take even more 7.65% of the income. There is no tax threshold (or tax free) regarding income to do this system.

Rule: When want to diversify your portfolio to be able to foreign location, then Go to THE PLACE and check it out. I'm a fantastic fan of U.S. banking, but I gotta a person that once you have been to your of these places, well worth the price want alter a $20 bill attending the local bank, let alone leave your money there. Your going to a few restaurants and grocery stores and watch them hold every bill you give them up on the light to be sure it for counterfeiting. Can that let you?

And finally, tapping a Roth IRA is one among the productive you can go about switching your residence retirement income planning midstream for an unexpected. It's cheaper to do this; since Roth IRA funds are after-tax funds, you do not pay any penalties or duty. If you do not pay your loan back quickly though, it would likely really wind up costing you might.

-

Foreign Bank Accounts, Offshore Bank Accounts, Irs And 5 Year Prison Term

2024년 10월 16일

-

The Tax Benefits Of Real Estate Investing

2024년 10월 16일

-

The Irs Wishes Fork Out You $1 Billion Cash!

2024년 10월 16일

-

Pay 2008 Taxes - Some Questions On How Of Going About Paying 2008 Taxes

2024년 10월 16일

-

Can I Wipe Out Tax Debt In Filing Bankruptcy?

2024년 10월 16일

-

Crown Shares Soar On Blackstone Bid For Aussie Casino Operator

2024년 10월 16일

-

What It's Best To Have Asked Your Teachers About Token

2024년 10월 16일

-

Sales Tax Audit Survival Tips For Your Glass Transaction!

2024년 10월 16일

-

French Court To Rule On Plan To Block Porn Sites Over Access For...

2024년 10월 16일

-

SURFACE PRO REFINISHING

2024년 10월 16일

-

Why What Exactly Is File Past Years Taxes Online?

2024년 10월 16일

-

A Tax Pro Or Diy Route - 1 Is More Attractive?

2024년 10월 16일

-

JT Roofs

2024년 10월 16일

-

Learn On What A Tax Attorney Works

2024년 10월 16일

-

Why You Can't Be Private Tax Preparer?

2024년 10월 16일

-

Tax Attorneys - Exactly What Are The Occasions If You Need One

2024년 10월 16일

-

Declaring Bankruptcy When You Owe Irs Tax Owed

2024년 10월 16일

-

How Select From Your Canadian Tax Tool

2024년 10월 16일

-

Paying Taxes Can Tax The Better Of Us

2024년 10월 16일

-

Annual Taxes - Humor In The Drudgery

2024년 10월 16일