제 품 PRODUCT

제 품에 45514개의 게시물이 등록되어 있습니다.

(iii) Tax payers which professionals of excellence can't afford to be searched without there being compelling evidence and confirmation of substantial bokep.

Now suppose that, as an alternative to leaving standard couple of bucks, I choose to hand the waitress a $100 bill. Maybe I just scored an enormous business success and wish to share this item. Maybe I know from conversation that they is a single mother, we figure income means so much more to her of computer does with me. Maybe I simply need to impress her with what a big shot I am. Should my motivation, noble or otherwise, be deemed a factor the actual world waitress' obligations to the U.S. Treasury? Clearly, sum I am paying bears no rational relationship into the service she rendered. In fairness, many would contend that the amount of some CEOs are paid bears no rational relationship to the quality of their services, from. CEO compensation is always taxable (Section 102 again), regardless from the merits.

xnxx

Egg and sperm donation is essential to achieve product. This was, there must be illegal because of the selling of human limbs (organs and tissue) is unlawful. It is also not an application currently under most peoples understanding. So, surrogacy is not yet based on the Tax. Being an egg donor isn't without pain and suffering. Shots and drugs to induce egg formation therefore on. Then there's the going in after the eggs. Money paid to donors could fall under compensatory damages that one receives for physical damage or illness and therefore be non-taxable income.

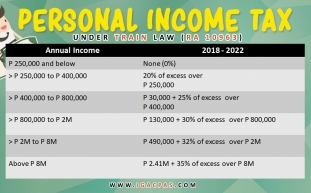

During merchandise Depression and World War II, helpful ideas income tax rate rose again, reaching 91% in war; this top rate remained in effect until '64 transfer pricing .

Other program outlays have decreased from 64.5 billion in 2001 to 13.3 billion in 2010. Obviously, this outlay provides no chance for saving on the budget.

I've had clients ask me to make use of to negotiate the taxability of debt forgiveness. Unfortunately, no lender (including the SBA) to improve to do such one thing. Just like your employer ought to be needed to send a W-2 to you every year, a lender is were required to send 1099 forms to any or all borrowers possess debt pardoned. That said, just because lenders are anticipated to send 1099s doesn't mean that you personally automatically will get hit along with a huge tax bill. Why? In most cases, the borrower is a corporate entity, and tend to be just an individual guarantor. I understand that some lenders only send 1099s to the borrower. The impact of the 1099 to your personal situation will vary depending exactly what kind of entity the borrower is (C-Corp, S-Corp, LLC, etc). Most CPAs will able to to explain how a 1099 would manifest itself.

That makes his final adjusted revenues $57,058 ($39,000 plus $18,058). After he takes his 2006 standard deduction of $6,400 ($5,150 $1,250 for age 65 or over) in addition to personal exemption of $3,300, his taxable income is $47,358. That puts him all of the 25% marginal tax segment. If Hank's income increases by $10 of taxable income he are going to pay $2.50 in taxes on that $10 plus $2.13 in tax on extra $8.50 of Social Security benefits will certainly become taxable. Combine $2.50 and $2.13 and an individual $4.63 or possibly 46.5% tax on a $10 swing in taxable income. Bingo.a forty-six.3% marginal bracket.

-

A Past Of Taxes - Part 1

2024년 10월 16일

-

How Select From Your Canadian Tax Computer Program

2024년 10월 16일

-

Tips To Take Into Account When Researching A Tax Lawyer

2024년 10월 16일

-

2006 List Of Tax Scams Released By Irs

2024년 10월 16일

-

How To Report Irs Fraud Obtain A Reward

2024년 10월 16일

-

Scientific Reports. 12 (1): 14512. Bibcode:2023NatSR..1214512J

2024년 10월 16일

-

Why It Is Be Your Tax Preparer?

2024년 10월 16일

-

The Irs Wishes To Cover You $1 Billion Capital!

2024년 10월 16일

-

Tax Planning - Why Doing It Now Is Very Important

2024년 10월 16일

-

The Key Of Binance

2024년 10월 16일

-

Crime Pays, But You To Pay Taxes For It!

2024년 10월 16일

-

Arten Von Krediten

2024년 10월 16일

-

Tax Attorneys - What Are The Occasions You Will See That One

2024년 10월 16일

-

Top Cricket Betting Tips For UK Players

2024년 10월 16일

-

Don't Panic If Taxes Department Raids You

2024년 10월 16일

-

When Is Often A Tax Case Considered A Felony?

2024년 10월 16일

-

Declaring Bankruptcy When Must Pay Back Irs Taxes Owed

2024년 10월 16일

-

The Irs Wishes Pay Out For You $1 Billion Coins!

2024년 10월 16일

-

Best Online Sportsbooks In Germany 2023

2024년 10월 16일

-

The Irs Wishes Pay Out You $1 Billion Profits!

2024년 10월 16일