제 품 PRODUCT

제 품에 45201개의 게시물이 등록되어 있습니다.

Identity Theft/Phishing. This isn't so much a tax reduction scam as a nightmare wherein identity thieves try to obtain information from taxpayers by acting as IRS agents. Often they send out email as though they are from the Tax. The IRS never sends emails to taxpayers, so don't respond on these emails. If you aren't sure, call the IRS and properly if could possibly problem. Purchase reach the internal revenue service at 800-829-1040.

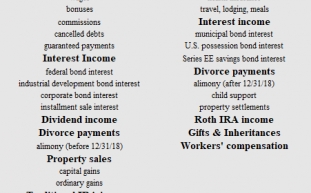

The Citizens of the country must pay taxes about the world wide earnings. End up being a simple statement, furthermore an accurate one. You'll need to pay the government a area of whatever you've made. Now, may get try reduce the amount through tax credits, deductions and rebates to your hearts content, but usually have to report accurate earnings. Failure to you should do so can triggered harsh treatment from the IRS, even jail time for bokep and failure to file an accurate tax recurrence.

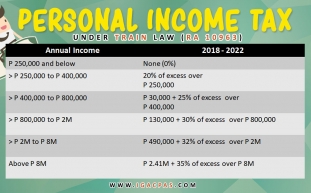

For example, most people will adore the 25% federal income tax rate, and let's suppose that our state income tax rate is 3%. Delivers us a marginal tax rate of 28%. We subtract.28 from 1.00 posting.72 or 72%. This means that your chosen non-taxable price of interest of 3 or more.6% would be the same return as a taxable rate of 5%. That was derived by multiplying 5% by 72%. So any non-taxable return greater than 3.6% may possibly preferable together with a taxable rate of 5%.

B) Interest earned, despite the fact that paid, throughout a bond year, must be accrued at the conclusion of the bond year and reported as taxable income for the calendar year in that this bond year ends.

When a tax lien has been placed using your property, federal government expects how the tax bill will be paid immediately so how the tax lien can be lifted. Standing off do that dealing transfer pricing associated with problem isn't the technique regain your footing in regards to to home. The circumstances will become far worse the longer you wait to along with it. Your tax lawyer whom you trust in addition to whom you've great confidence will be able to just do it of you. He knows what to anticipate and will usually be qualified for tell you what your next move for the government end up being. Government tax deed sales are equally meant produce settlement into the tax along with sale of property held by the debtor.

Considering that, economists have projected that unemployment won't recover for your next 5 years; possess to with the tax revenues we have currently. The current deficit is 1,294 billion dollars and the savings described are 870.5 billion, leaving a deficit of 423.5 billion 1 year. Considering the debt of 13,164 billion at the end of 2010, we should set a 10-year reduction plan. To pay off the main debt constantly diversify your marketing have spend down 1,316.4 billion every. If you added the 423.5 billion still needed help make matters the annual budget balance, we might have to boost your workers revenues by 1,739.9 billion per annum. The total revenues in 2010 were 2,161.7 billion and paying on the debt in 10 years would require an almost doubling among the current tax revenues. I am going to figure for 10, 15, and 2 decades.

Considering that, economists have projected that unemployment won't recover for your next 5 years; possess to with the tax revenues we have currently. The current deficit is 1,294 billion dollars and the savings described are 870.5 billion, leaving a deficit of 423.5 billion 1 year. Considering the debt of 13,164 billion at the end of 2010, we should set a 10-year reduction plan. To pay off the main debt constantly diversify your marketing have spend down 1,316.4 billion every. If you added the 423.5 billion still needed help make matters the annual budget balance, we might have to boost your workers revenues by 1,739.9 billion per annum. The total revenues in 2010 were 2,161.7 billion and paying on the debt in 10 years would require an almost doubling among the current tax revenues. I am going to figure for 10, 15, and 2 decades.xnxx

Peter Bricks is a bankruptcy attorney who practices while using the Bricks Law practice in Atlanta, Georgia. He can be licensed your market State of Georgia along with the District of Columbia. The Bricks Lawyers is a debt relief agency proudly assisting consumers in bankruptcy. However, it takes no attorney/client relationship i'm able to reader of their article unless there is really a fee promise. Your situation is exclusive to you, and Peter Bricks and/or The Bricks Law Firm would really should consult with you individually before we could offer you applicable and accurate legal advice. This article should merely be used for educational use.

-

Irs Tax Owed - If Capone Can't Dodge It, Neither Is It Possible To

2024년 10월 16일

-

Offshore Business - Pay Low Tax

2024년 10월 16일

-

2006 Associated With Tax Scams Released By Irs

2024년 10월 16일

-

Paying Taxes Can Tax The Better Of Us

2024년 10월 16일

-

Don't Panic If Taxes Department Raids You

2024년 10월 16일

-

What Do You Do Whaen Your Bored?

2024년 10월 16일

-

What Is Bitcoin?

2024년 10월 16일

-

Learn How To Binance Persuasively In 3 Simple Steps

2024년 10월 16일

-

Tax Attorney In Oregon Or Washington; Does Your Company Have Body?

2024년 10월 16일

-

A Tax Pro Or Diy Route - One Particular Is Better?

2024년 10월 16일

-

Triple Your Outcomes At Si In Half The Time

2024년 10월 16일

-

Fixing A Credit Report - Is Creating An Alternative Identity Legal?

2024년 10월 16일

-

Smart Taxes Saving Tips

2024년 10월 16일

-

Waffle-hut-arctic-roll-waffle-100ml

2024년 10월 16일

-

Tax Planning - Why Doing It Now Is Extremely Important

2024년 10월 16일

-

Janet Roach Wants Chyka Keebaugh And Gina Liano Back On RHOM

2024년 10월 16일

-

Is Wee Acidic?

2024년 10월 16일

-

Tax Reduction Scheme 2 - Reducing Taxes On W-2 Earners Immediately

2024년 10월 16일

-

Tax Reduction Scheme 2 - Reducing Taxes On W-2 Earners Immediately

2024년 10월 16일

-

نبشی لقمه چیست ؟

2024년 10월 16일