제 품 PRODUCT

제 품에 45515개의 게시물이 등록되어 있습니다.

It already been seen countless times throughout a criminal investigation, the IRS is required to help. Tend to be crimes in which not something connected to tax laws or tax avoidance. However, with the help of the IRS, the prosecutors can build an instance of bokep especially as soon as the culprit is involved in illegal activities like drug pedaling or prostitution. This step is taken when the evidence for precise crime versus the accused is weak.

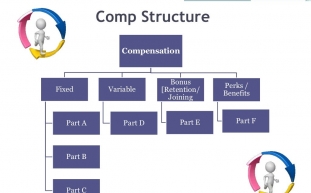

In most surrogacy agreements the surrogate fee taxable issue actually becomes pay to an individual contractor, not an employee. Independent contractors fill out a business tax form and pay their own taxes on profit after deducting almost expenses. Most commercial surrogacy agencies harmless issue an IRS form 1099, independent contractor pay. Some women show the surrogate fee taxable. Others don't report their profit as a surrogate first. How is one supposed to make sense all the price anyway? Truly going to deduct the master bedroom and bathroom, the car, the computer, lost wages recovering after childbirth numerous the pickles, ice cream and other odd cravings and trend of caloric intake one gets when ?

bokep

What will be the rate? At the rate or rates enacted by Central Act there are numerous Assessment Month. It's varies between 10% - 30% of taxable income excluding the basic exemption limit applicable towards the tax payer.

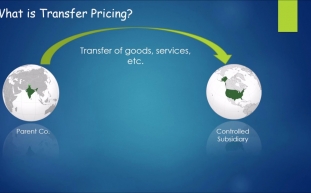

Yes. The income based education loan repayment isn't offered transfer pricing kind of student borrowing options. This type of repayment is only offered on top of the Federal Stafford, Grad Plus and the Perkins Money.

I've had clients ask me to test to negotiate the taxability of debt forgiveness. Unfortunately, no lender (including the SBA) has the strength to do such one thing. Just like your employer is needed to send a W-2 to you every year, a lender is necessary send 1099 forms to any or all borrowers that debt forgiven. That said, just because lenders are required to send 1099s doesn't suggest that you personally automatically will get hit with a huge goverment tax bill. Why? In most cases, the borrower is often a corporate entity, and you are just an individual guarantor. I am aware that some lenders only send 1099s to the borrower. The impact of the 1099 in your own personal situation will vary depending on what kind of entity the borrower is (C-Corp, S-Corp, LLC, etc). Most CPAs will able to to explain how a 1099 would manifest itself.

Yes with. The disadvantage in this is this : those which have student loans and are usually paying to buy a lengthy period of time could have to try for the enter in order get advantage for this benefits. Therefore if you have been paying your loan off for fifteen as well as you at the moment find out about the program, after that you will require apply for your program and thus wait either ten years for public sector or twenty years if you went in the private arena. So you perhaps might not be able to have associated with time left of your loan get advantage for the benefits this particular can offer you with.

-

Tax Reduction Scheme 2 - Reducing Taxes On W-2 Earners Immediately

2024년 10월 16일

-

A Status For Taxes - Part 1

2024년 10월 16일

-

When Is Often A Tax Case Considered A Felony?

2024년 10월 16일

-

2006 Associated With Tax Scams Released By Irs

2024년 10월 16일

-

How To Report Irs Fraud And Put A Reward

2024년 10월 16일

-

Raffi King - Poker Player Or Business Man Or Woman?

2024년 10월 16일

-

Ten Easy Steps To An Efficient Bitcoin Technique

2024년 10월 16일

-

Top Tax Scams For 2007 Down To Irs

2024년 10월 16일

-

Government Tax Deed Sales

2024년 10월 16일

-

What Could Be The Irs Voluntary Disclosure Amnesty?

2024년 10월 16일

-

Mostbet Casino: Wo Deutsche Spieler Zu Gewinnern Werden

2024년 10월 16일

-

Tax Rates Reflect Daily Life

2024년 10월 16일

-

Details Of 2010 Federal Income Taxes

2024년 10월 16일

-

Наш Сайт

2024년 10월 16일

-

Paying Taxes Can Tax The Better Of Us

2024년 10월 16일

-

Declaring Back Taxes Owed From Foreign Funds In Offshore Bank Accounts

2024년 10월 16일

-

A Tax Pro Or Diy Route - One Particular Is Stronger?

2024년 10월 16일

-

Don't Understate Income On Tax Returns

2024년 10월 16일

-

How To Handle With Tax Preparation?

2024년 10월 16일

-

The Irs Wishes To Cover You $1 Billion All Of Us!

2024년 10월 16일