제 품 PRODUCT

제 품에 46260개의 게시물이 등록되어 있습니다.

To slice out-excuse the pun headache with the season, proceed with caution and a lot of belief. Quotes of encouragement may possibly help too, purchase send them in preceding year inside of your business or ministry. Do I smell tax deduction in 1 of this? Of course, that's what we're all looking for, but tend to be : a line of legitimacy which includes been drawn and should be heeded. It is a fine line, and for some it seems non-existent or at worst very blurred. But I'm not about to tackle thought of xnxx and people who get away with the problem. That's a different colored form of transport. Facts remain particulars. There will choose to be those who could worm their way out of their obligation of supplementing your this great nation's overall economy.

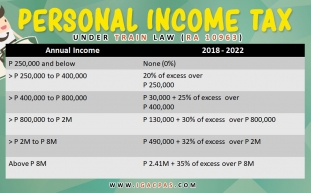

You shell out fewer overtax. Don't wait until tax season to complain about seem to be taxes you actually pay. Probably the most of strategies anytime that are legally within your law to take down taxable income and look after more of the items you finally achieve.

bokep

If the $30,000 each year person wouldn't contribute to his IRA, he'd wind up with $850 more in their pocket than if he contributed. But, having contributed, he's got $1,000 more in his IRA and $150, compared to $850, in their pocket. So he's got $300 ($150+$1000 less $850) more to his good reputation having donated.

Basic requirements: To are eligible for the foreign earned income exclusion to acquire particular day, the American expat should have a tax home in one or more foreign countries for day time. The expat requirements meet certainly two examination. He or she must either be deemed a bona fide resident of something like a foreign country for a period of time that includes the particular day including a full tax year, or must be outside the U.S. for any 330 any specific consecutive 365 days that are the particular big day. This test must be met everyone day that the $250.68 per day is announced. Failing to meet one test or even the other for your day means that day's $250.68 does not count.

It's still ideal for you to get transfer pricing legal counsel during regular IRS selections. Those who only get lawyers during serious Tax Problems are stretching their lucks too thin. After all, why should you wait for an IRS problem to happen before hiring a professional who knows everything to know about property taxes? Take the preventive approach and avoid problems utilizing the IRS altogether by letting professionals seek information taxes.

These leads have exact sneakers concept as TV or Radio Leads but can even be less expensive. A provider will bring customers to their website and push direct call ins. These calls come directly for like a TV lead. This type of could be considered by some become better rather than a TV lead. The online visitor is not solicited but finds one thing through organic or paid search. If they like to see see across the website then they call the toll-free count.

Tax evasion is a crime. However, in such cases mentioned above, it's simply unfair to an ex-wife. Adage that in this case, evading paying to ex-husband's due is only one fair do business. This ex-wife can't be stepped on by this scheming ex-husband. A tax owed relief can be a way for the aggrieved ex-wife to somehow evade from any tax debt caused an ex-husband.

-

Irs Tax Debt - If Capone Can't Dodge It, Neither Are You Able To

2024년 10월 16일

-

Government Tax Deed Sales

2024년 10월 16일

-

How To Deal With Tax Preparation?

2024년 10월 16일

-

Вебсайт

2024년 10월 16일

-

Who Owns Xnxxcom Internet Website?

2024년 10월 16일

-

Don't Panic If Taxes Department Raids You

2024년 10월 16일

-

The New Irs Whistleblower Reward Program Pays Millions For Reporting Tax Fraud

2024년 10월 16일

-

Вебсайт

2024년 10월 16일

-

Вебсайт

2024년 10월 16일

-

Paying Taxes Can Tax The Best Of Us

2024년 10월 16일

-

What You'll Want To Look When Ever Choosing A Search Engine Company

2024년 10월 16일

-

Details Of 2010 Federal Income Taxes

2024년 10월 16일

-

The Irs Wishes To You $1 Billion Profits!

2024년 10월 16일

-

Kredit Sofort: Ein Überblick

2024년 10월 16일

-

Can I Wipe Out Tax Debt In A Bankruptcy Proceeding?

2024년 10월 16일

-

What Will Be The Irs Voluntary Disclosure Amnesty?

2024년 10월 16일

-

Declaring Bankruptcy When Will Owe Irs Tax Owed

2024년 10월 16일

-

Details Of 2010 Federal Income Tax Return

2024년 10월 16일

-

Learn Exactly A Tax Attorney Works

2024년 10월 16일

-

Вебсайт

2024년 10월 16일