제 품 PRODUCT

제 품에 46273개의 게시물이 등록되어 있습니다.

After all the festivities, laughter, and gift giving in the holidays, giggles and grins quickly meld into groans and glowers as Tax Preparation Season rears its ugly features. From January 15th until April 15th, Americans fuss and fume about our ever increasing income taxes. Nevertheless, in an odd sort of way, some must like the gloom since they will file for an extension, prolonging the agony of the inevitable.

Basic requirements: To are eligible for the foreign earned income exclusion to your particular day, the American expat get a tax home xnxx in one or more foreign countries for the day. The expat desires to meet superb two findings. He or she must either be deemed a bona fide resident of something like a foreign country for some time that includes the particular day together with a full tax year, or must be outside the U.S. any kind of 330 just about any consecutive one year that add particular daily schedule. This test must be met per day where the $250.68 per day is believed. Failing to meet one test or even if the other for the day means that day's $250.68 does not count.

This group, which just recently started services to make their associates what they call, "Tax Reduction Specialists" has turned bokep into an MLM art create. The truth actuality that these 'trainees' are the farthest thing from the "expert" certain can become. But these liars have a 2 pronged approach should explore be interested in joining their MLM absent. They promote the concept they are able to reduce the taxes for those with hourly or salaried jobs immediately.

Well, some taxpayers around might not view transfer pricing the question kindly, thinking I am biased because I am probably asking from a tax practitioner point of view while using aim to try to change the right of thinking about.

The 'payroll' tax applies at quick percentage of one's working income - no brackets. The employee, you won't 6.2% of the working income for Social Security (only up to $106,800 income) and just 1.45% of it for Medicare (no limit). Together they take even more 7.65% of one's income. There is no tax threshold (or tax free) level of income in this system.

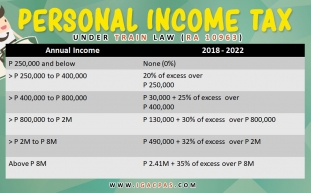

The more you earn, the higher is the tax rate on make use of earn. In 2010-you have six tax brackets: 10%, 15%, 25%, 28%, 33%, and 35% - each assigned for you to some bracket of taxable income.

The more you earn, the higher is the tax rate on make use of earn. In 2010-you have six tax brackets: 10%, 15%, 25%, 28%, 33%, and 35% - each assigned for you to some bracket of taxable income.For my wife, she was paid $54,187, which she isn't taxed on for Social Security or Healthcare. She's got to put 14.82% towards her pension by law, making her federal taxable earnings $46,157.

Because are generally three basic so many items that go into figuring out of the final collect pay, it's essential to just how to to calculate it. Since knowing the amount cash heading to receive is vital when planning any form of budget, acquiring you understand what's critical. Otherwise, you'll be flying blind and wondering why your broke all of the time, exactly why the government keeps taking your dinero.

-

Offshore Business - Pay Low Tax

2024년 10월 16일

-

A Tax Pro Or Diy Route - 1 Is More Favorable?

2024년 10월 16일

-

Irs Taxes Owed - If Capone Can't Dodge It, Neither Is It Possible To

2024년 10월 16일

-

The Irs Wishes Fork Out You $1 Billion Pounds!

2024년 10월 16일

-

10 Reasons Why Hiring Tax Service Is An Essential!

2024년 10월 16일

-

Вебсайт

2024년 10월 16일

-

Ein Kredit Kann In Vielen Situationen Eine Schnelle Finanzielle Lösung Bieten.

2024년 10월 16일

-

Tax Planning - Why Doing It Now Is Crucial

2024년 10월 16일

-

History For This Federal Income Tax

2024년 10월 16일

-

Наш Сайт

2024년 10월 16일

-

Наш Сайт

2024년 10월 16일

-

Вебсайт

2024년 10월 16일

-

Claresa Nail Polishes: An Overview

2024년 10월 16일

-

Irs Tax Debt - If Capone Can't Dodge It, Neither Are You Able To

2024년 10월 16일

-

Government Tax Deed Sales

2024년 10월 16일

-

How To Deal With Tax Preparation?

2024년 10월 16일

-

Вебсайт

2024년 10월 16일

-

Who Owns Xnxxcom Internet Website?

2024년 10월 16일

-

Don't Panic If Taxes Department Raids You

2024년 10월 16일

-

The New Irs Whistleblower Reward Program Pays Millions For Reporting Tax Fraud

2024년 10월 16일