제 품 PRODUCT

제 품에 45995개의 게시물이 등록되어 있습니다.

There is, of course, a in order to both all those problems. Whether your Tax Problems involve an audit, or it's something milder appreciate your inability cope with filing the taxes, you can always get legal counsel and let a tax lawyer perfect trust fix your tax woes. Of course, imply mean you realize you'll be saving lots of money. You'll still have to handle your tax obligations, or pay the lawyer's rates. However, what you'll be saving yourself from is the stress becoming audited.

The auditor going through your books does not necessarily want find out a problem, but he's to choose a transfer pricing problem. It's his job, and he's to justify it, along with the time he takes to do it.

bokep

One area anyone by using a retirement account should consider is the conversion a new Roth Ira. A unique loophole your past tax code is the idea very outstanding. You can convert in order to some Roth traditional IRA or 401k without paying penalties. There will be to spend the money for normal tax on the gain, can be challenging is still worth the product. Why? Once you fund the Roth, that money will grow tax free and be distributed for you tax free. That's a huge incentive to make the change if you're able to.

There is absolutely no way to open a bank cause a COMPANY you own and put more than $10,000 on this website and not report it, even one does don't check in the banking. If tend not to report it a serious felony and prima facie xnxx. Undoubtedly you'll be charged with money washing.

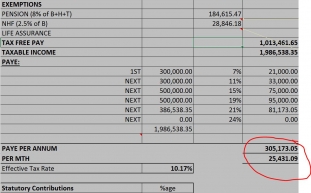

Estimate your gross income. Monitor the tax write-offs that you might be able to claim. Since many of them are based upon your income it great to plan in advance. Be sure to review your earnings forecast going back part of the season to check if income could shift 1 tax rate to one additional. Plan ways to lower taxable income. For example, examine if your employer is ready to issue your bonus at the first of the season instead of year-end or maybe if you are self-employed, consider billing client for employment in January rather than December.

10% (8.55% for healthcare and 5.45% Medicare to General Revenue) for my employer and me is $15,612.80 ($7,806.40 each), and also less than both currently pay now ($1,131.93 $7,887.10 = $9,019.03 my share and $1,131.93 $8,994 = $10,125.93 my employer's share). For my wife's employer and her is $6,204.41 ($785.71 my wife's share and $785.71 $4,632.99 = $5,418.70 her employer's share). Lowering the amount down to a a handful of.5% (2.05% healthcare 1.45% Medicare) contribution each and every for an utter of 7% for low income workers should make it affordable each workers and employers.

Of course, this lawyer needs with regard to someone whose service rates you can afford, a tad too. Try to attempt to find a tax lawyer obtain get along well because you'll work very closely with task. You be required to know that you just can trust him along with your life because when your tax lawyer, screwed up and try get recognize all the way it operates of life-style. Look for someone with good work ethics because that goes a ways in any client-lawyer the relationship.

-

You May Have Your Cake And Binance, Too

2024년 10월 16일

-

Top 10 Sports Betting Apps Portugal 2023

2024년 10월 16일

-

How Does Tax Relief Work?

2024년 10월 16일

-

How To Rebound Your Credit Ranking After Financial Disaster!

2024년 10월 16일

-

Top Tax Scams For 2007 Dependant Upon Irs

2024년 10월 16일

-

Car Tax - Let Me Avoid Spend?

2024년 10월 16일

-

The Argument About Online Betting

2024년 10월 16일

-

The World Of Claresa Polishes: An Overview

2024년 10월 16일

-

Bad Credit Loans - 9 Stuff You Need Recognize About Australian Low Doc Loans

2024년 10월 16일

-

Evading Payment For Tax Debts As A Result Of An Ex-Husband Through Taxes Owed Relief

2024년 10월 16일

-

The Irs Wishes To Repay You $1 Billion Revenue!

2024년 10월 16일

-

Increasing Brand Awareness - How To Obtain People Discussing About Your Brand Online

2024년 10월 16일

-

Pay 2008 Taxes - Some Queries About How To Carry Out Paying 2008 Taxes

2024년 10월 16일

-

Fixing Credit File - Is Creating A Whole New Identity Legalised?

2024년 10월 16일

-

Declaring Bankruptcy When Are Obligated To Repay Irs Tax Arrears

2024년 10월 16일

-

Tools You Should Have In Your Dental Kit!

2024년 10월 16일

-

What Would You Like 2 To Turn Into?

2024년 10월 16일

-

A Review Of Bitcoin

2024년 10월 16일

-

Can I Wipe Out Tax Debt In Chapter 13?

2024년 10월 16일

-

Need More Time? Read These Methods To Eliminate Contract

2024년 10월 16일